1.The trade of goods has experienced rapid growth, with the trade structure continuing to improve and optimize

According to the report released by National Bureau of Statistics on March 18, 2024, during the first two months in 2024, the total trade volume of goods reached CNY 6.6138 trillion, marking an 8.7% increase year-on-year. Specifically, exports amounted to CNY 3.7523 trillion, up by 10.3%, while imports totaled CNY 2.8615 trillion, showing a 6.7% increase. The trade surplus stood at CNY 890.9 billion ($123.46 billion).

General trade, which represents 65.7% of the total trade volume, saw a 10.0% increase compared to the same period last year, gaining 0.8 percentage points in its share of total trade. Private enterprises experienced a 17.7% growth in trade, accounting for 54.6% of the total, which is an increase of 4.2 percentage points from the previous year. Additionally, exports of mechanical and electrical products rose by 11.8%, constituting 59.1% of the total export volume.

Data Source: https://www.stats.gov.cn/sj/zxfb/202403/t20240318_1948494.html

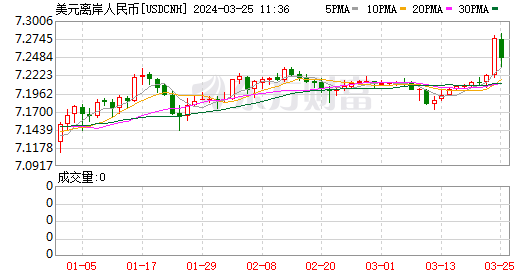

2.The U.S. dollar broke through the 7.26 level against the offshore Chinese yuan last week

On March 22, 2024, the U.S. dollar index surged, exerting downward pressure on the Chinese yuan exchange rate. During this period, the onshore yuan exchange rate against the U.S. dollar fell below 7.22, dropping more than 250 points within the day; meanwhile, the offshore yuan exchange rate against the U.S. dollar breached 7.26, plummeting nearly 500 points, both surpassing the highs since November 17, 2023.

In parallel, last week, the A-share market continued its volatile adjustments, with the three major indices each falling by more than 1%. By the midday close, the Shanghai Composite Index fell by 1.41%, the Shenzhen Component Index decreased by 1.71%, and the ChiNext Index dropped by 1.83%. The total transaction volume for the Shanghai and Shenzhen stock markets reached CNY 679.3 billion in the half-day, slightly contracting by CNY 18 billion compared to the same period in the previous trading session.

On March 25, the central parity rate of the Chinese yuan against the U.S. dollar was adjusted upwards by 8 basis points, reported at 7.0996.

Wang Qing, chief macro analyst at Orient Securities, analyzed that the yuan’s exchange rate is mainly influenced by two factors: the trend of the U.S. dollar, which can lead to passive appreciation or depreciation of the yuan against the dollar, and the overall economic environment within China, which influences the value and trend of CNY.

Experts believe that the yuan’s return to its previous strength depends on the convergence of positive factors, still reliant on the combined force of internal and external elements. Factors such as a weakening U.S. dollar index, sustained consolidation of the macroeconomic recovery, and further improvement in the stock market performance are expected to help the yuan exchange rate break out of its current range.

3.With RMB 44.5 billion of debt weighing on it, can Vanke not carry it as well?

On March 19, a noticeable decline was observed in the value of several bonds issued by Vanke. Specifically, the “20 Vanke 08” bond experienced an 11.78% decrease, the “21 Vanke 04” bond fell by 3.82%, and the “20 Vanke 06” bond saw a marginal decline of 0.37%. These events mark the onset of a challenging period for Vanke, as the company is poised to encounter a significant peak in debt repayment obligations over the next year. Vanke is expected to fulfill financial commitments exceeding CNY 44.5 billion, which include the repayment of three international debts totaling $2.675 billion.

In response to its looming debt obligations, Vanke has initiated several strategic measures to fortify its financial position. The company successfully divested a 50% interest in Shanghai Vanke Qibao Plaza to Hong Kong Link REIT and is planning to offload its holdings in long-term rental apartment ventures. These actions underscore that Vanke urgently needs to recoup funds to cope with the upcoming peak of debt repayment and exhaust all means to prevent a debt default.

Furthermore, Vanke’s leadership is proactively engaging with various insurance firms to explore a more adaptable approach to debt management. The aim is to enhance debt distribution and alleviate the pressures associated with short-term debt repayments.

Nevertheless, amid the ongoing downturn in the real estate sector, Vanke, once a market leader, is confronting significant challenges in maintaining its financial stability as well.

4.Xpeng faces a critical situation, as well as other leading Chinese EV brands

On March 19, Xpeng Motor unveiled its financial results for Q4 and the entirety of 2023. The company’s annual revenue reached CNY 30.68 billion, a 14.2% increase from the previous year, with vehicle deliveries escalating by 16.7% to 142,000 units. Despite a quarter-on-quarter reduction in net loss during Q4, the annual net loss widened to CNY 10.38 billion in 2023, up from CNY 9.14 billion in 2022. Notably, Xpeng Motor’s gross margins experienced a significant decline, plummeting from 12.5% in 2021 to 1.5% in 2023.

The company attributed its financial downturn to several factors, including inventory provisions, losses related to purchase commitments amidst model upgrades, heightened sales promotions, and the cessation of new-energy vehicle subsidies. These elements collectively impacted the gross profit margin of Xpeng’s vehicles, as reported during the company’s earnings conference.

Comparatively, in 2023, Li Auto and NIO posted gross margins of 22.2% and 5.5%, respectively. Within China’s trio of leading new energy vehicle firms, BYD emerged as the market frontrunner, recording a net income of CNY 21.3 billion. Following BYD, Li Auto reported a net income of CNY 11.8 billion, respectively, while NIO incurred a net loss of CNY 20.7 billion.

Meanwhile, Xiaomi Group announced a net income of CNY 19.2 billion from its entire business operations, despite not having sold a single car yet. The question remains: will the entry into the electric vehicle (EV) sector impact Xiaomi’s financial results positively or negatively? Given the fiercely competitive market landscape, it’s challenging to definitively lean towards one outcome at the beginning of 2024.

This financial landscape underscores the intense competitive pressures within China’s EV market, marked by a price war that challenges the profitability and sustainability of industry players. In the past five years, amidst fierce competition involving over 400 brands in the domestic market, merely about 40 Chinese EV brands have managed to endure and remain operational.

5.CATL distributed CNY 22 billion in dividends as its revenue exceeded CNY 400 billion

Amidst the fierce competition in China’s electric vehicle (EV) sector, Contemporary Amperex Technology Co., Limited (CATL) unveiled its remarkable financial performance for 2023. The firm recorded an unprecedented net profit of over CNY 40 billion and a revenue milestone exceeding CNY 400 billion for the first time. These financial achievements led to a considerable increase in CATL’s stock value, enhancing the company’s market capitalization beyond CNY 830 billion. Additionally, CATL introduced a dividend scheme distributing over CNY 22 billion to its shareholders, translating to nearly CNY 503 per lot of CATL stock, effectively returning almost half of its profits in dividends.

Since its establishment in 2010, CATL has ascended to the forefront of global power battery market, capitalizing on the burgeoning new energy sector. Today, it stands among the most significant private entities globally, with a valuation reaching the trillion-dollar mark. In 2023, CATL’s commitment to innovation was evident in its CNY 18.356 billion investment in research and development, which has fortified its technological prowess.

The company is poised to retain its global dominance in power battery applications, anticipating a 36.8% market share in 2023. It is also expected to maintain its leadership in the energy storage battery market, projecting a 40% global share for the third consecutive year.

Zeng Yuqun, CATL’s chairman, anncounced that ‘ With the AI industry’s rapid expansion, CATL is positioned for another phase of growth, leveraging its innovation and market leadership to navigate the future of energy and technology’. He highlighted the company’s strategic vision in response to the evolving new energy landscape and the emerging AI era’s increased demands on power supply capabilities. CATL is set to play a pivotal role in constructing the new energy infrastructure for this new period.

Will this CATL mission become a reality? Will CATL maintain its leading position in the upcoming AI era?

0 Comments