1.China’s Imports Up 1.8% and Exports Up 7.6% Year-on-Year in May

On Friday, June 7, the General Administration of Customs announced that China’s imports in May 2024 increased by 1.8% y-o-y to $219.73 billion, compared to a previous y-o-y growth of 8.4%. Exports rose by 7.6% y-o-y to $302.35 billion, up from a 1.5% increase in the prior month.

Customs statistics indicate that in the first five months, China’s general trade, processing trade, and bonded logistics imports and exports all saw growth. General trade imports and exports totaled $1.57 trillion, a 5.6% increase y-o-y, accounting for 65.1% of the total foreign trade value. Processing trade imports and exports reached $420 billion, up 1.6%, making up 17.3% of the total. Bonded logistics imports and exports amounted to $330 billion, up 16.5%. Trade with ASEAN countries totaled $81.81 billion, a 7.2% increase y-o-y.

Customs data also revealed that electromechanical products made up nearly 60% of exports, with significant growth in automatic data processing equipment and components, integrated circuits, and automobiles. In the first five months, China’s exports of electromechanical products reached $810 billion, a 7.9% increase y-o-y, representing 59% of total exports. This includes $76.45 billion in automatic data processing equipment and components, up 9.9%; $61.32 billion in integrated circuits, up 25.5%; and $45.45 billion in automobiles, up 23.8%. Additionally, imports of major commodities such as iron ore, coal, natural gas, and soybeans have increased.

Data Source:http://gdfs.customs.gov.cn/customs/302249/zfxxgk/2799825/302274/302275/5917142/index.html

http://gdfs.customs.gov.cn/customs/302249/zfxxgk/2799825/302274/302275/5917217/index.html

http://gdfs.customs.gov.cn/customs/302249/zfxxgk/2799825/302274/302275/5917202/index.html

http://gdfs.customs.gov.cn/customs/302249/zfxxgk/2799825/302274/302275/5917185/index.html

2.Dragon Boat Festival Holiday Witnesses 110 Million Domestic Tourists in China

During the 2024 Dragon Boat Festival holiday, China saw a total of 110 million domestic tourist trips, representing a 6.3% y-o-y increase, according to the Ministry of Culture and Tourism’s Data Center. Domestic tourist spending reached CNY 40.35 billion, up 8.1% y-o-y.

Ctrip data reveals significant growth in specific regions and events. Car rental orders in Foshan, Guangdong, where the Dejiu Dragon Boat Drifting Race was held, surged by 250% y-o-y. In Yueyang, Hunan, which hosted the 2024 China Miluo River Dragon Boat Super League, tourism orders increased by 52%. The 11th Peach Blossom Lake Dragon Boat Race in Xuancheng, Anhui, boosted holiday tourism orders by 32%. The popularity of the TV series “My Altay” spurred continuous interest in self-driving tours to Xinjiang’s Altay and Ili regions, with Urumqi car rental orders doubling and Yining City seeing a 140% increase.

Many tourists opted for local leisure or short-distance travel, favoring suburban activities such as water recreation, fruit picking, farming experiences, and camping. Cultural venues and commercial streets became primary leisure spaces. National-level nighttime cultural and tourism consumption clusters organized Dragon Boat Festival-themed activities like intangible cultural heritage experiences and folk markets, enhancing nighttime economic vitality.

Tourists increasingly prefer flexible and personalized travel options, enjoying life through slow-paced trips, in-depth experiences, and relaxation. Yunnan, Qinghai, Gansu, Inner Mongolia, and Guizhou have become popular destinations for young people seeking self-driving and summer getaways.

Data Source:https://news.cctv.com/2024/06/10/ARTImdAY3Bo8cUkLABiAeMs0240610.shtml

3.China’s New Energy Vehicle Market Sees 790,000 Units Sold in May, Up 36% Year-on-Year

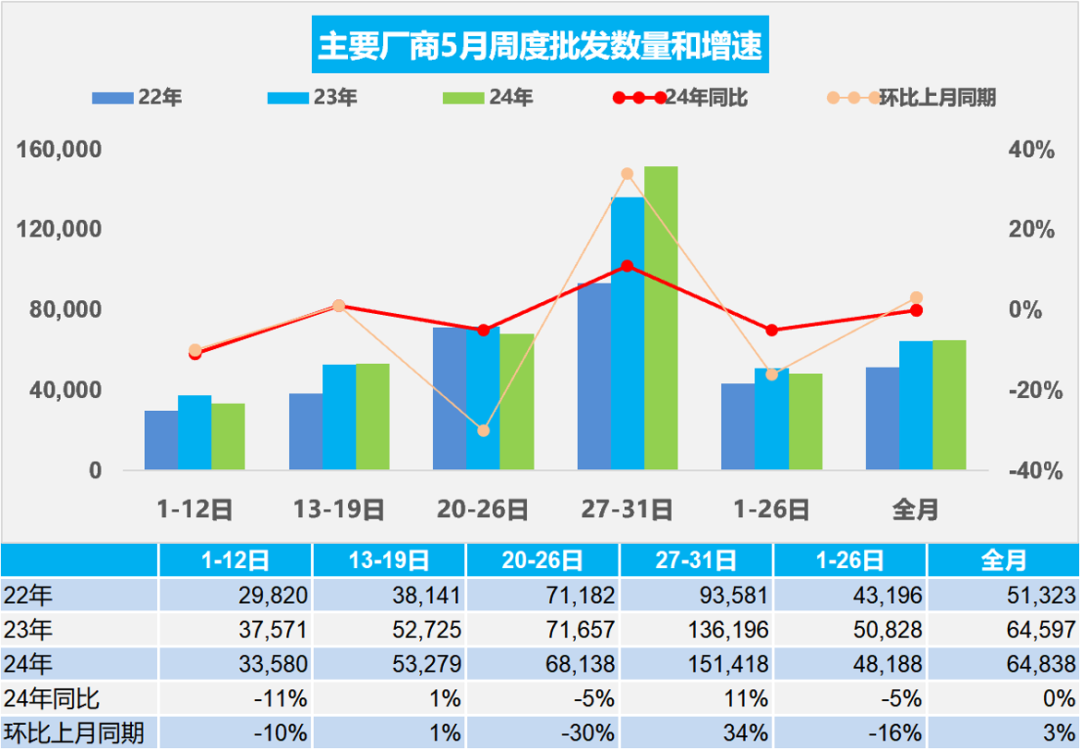

According to data from the China Passenger Car Association (CPCA), retail sales in the passenger car market reached 1.685 million units in May, a 3% y-o-y decrease but a 10% month-on-month increase. Since the beginning of 2024, cumulative retail sales have reached 8.052 million units, up 5% y-o-y. Wholesale volumes in May hit 2.01 million units, flatting as last year but increasing by 3% m-o-m. Cumulatively, wholesale volumes have totaled 9.56 million units since the start of 2024, representing an 8% year-on-year increase.

In the new energy vehicle (NEV) market, May saw retail sales of 790,000 units, a 36% y-o-y increase and a 17% m-o-mo rise. Cumulative NEV retail sales for 2024 have reached 3.242 million units, marking a 34% y-o-y growth. NEV wholesale volumes in May stood at 903,000 units, up 33% y-o-y and 15% m-o-m. Since the beginning of the year, NEV wholesale volumes have totaled 3.643 million units, up 31% y-o-y.

Top 10 New Energy Passenger Car Manufacturers by Sales in May:

- BYD: 330,488 units

- Tesla China: 72,573 units

- Geely Auto: 58,673 units

- Changan Automobile: 55,800 units

- GAC Aion: 40,073 units

- Chery Automobile: 39,413 units

- Li Auto: 35,020 units

- SAIC-GM-Wuling: 33,872 units

- Seres (Huawei): 32,377 units

- Great Wall Motor: 24,549 units

These figures underscore the robust growth of the NEV market in China.

4.Vanke Repays USD Debt on Schedule, No More Overseas Debt Due This Year

On the evening of June 5, 2024, Vanke announced that its wholly-owned subsidiary, Vanke Real Estate (Hong Kong), had issued a $600 million medium-term note in March 2019 with a coupon rate of 4.20% due on June 7, 2024. As of June 5, 2024, the principal amount and accrued interest totaled $612.6 million. Vanke has fully transferred this amount to its overseas bank account and will deposit the funds into the agent bank’s designated account on June 6, 2024, to fully repay the principal and interest due on the maturity date.

With the repayment of this note, Vanke has no more USD debt maturing this year. However, the company still faces domestic debt obligations. According to Eastmoney, Vanke’s domestic debt maturing within a year amounts to approximately CNY 16.04 billion, spread across nine bonds, representing 30.24% of its total debt balance.

Vanke’s Chairman, Yu Liang, stated that the company plans to reduce interest-bearing debt by over CNY 100 billion in the next two years and aims to cut the total interest-bearing debt by more than half over the next five years. Vanke will focus on its core businesses of comprehensive residential development, property services, and rental apartments, gradually exiting and divesting non-core businesses.

5.China Expands Visa-Free Entry and Boosts Tourism in the first five months 2024, But Long-Term Stays Decline

In December 2023, the Chinese government introduced visa-free stays of up to 15 days for travelers from France, Germany, Italy, the Netherlands, Spain, and Malaysia. This policy was extended to six more European countries in March 2024. Additionally, a new policy effective from mid-May allows all foreigners traveling in tour groups to enter China without a visa through Shanghai and 12 other cruise ports for a stay of up to 15 days.

This follows an already robust recovery in the first four months of the year, during which Shanghai received more than 1.23 million foreigners who spent at least one night in the city—a year-on-year increase of 250 percent, according to data released on May 28 by the Shanghai Municipal Administration of Culture and Tourism. This figure is nearly 70 percent of the pre-pandemic levels seen in the same period of 2019.

Despite these positive trends, fewer foreigners are opting to stay and work long-term in Shanghai. Several factors contribute to this decline:

1. Job Opportunities: Roles such as English teachers are becoming scarcer due to a drop in kindergarten admissions resulting from China’s falling birth rate and the closure of international schools in recent years.

2. Lower Confidence: Uncertainty about policies and the economy in a complex global context, particularly affecting sectors like architecture, education, and sales, is reducing foreigners’ confidence in life in China.

3. Cashless Society: China’s rapid shift to a cashless society has made it difficult for some foreigners to navigate daily life, restricting their ability to spend money freely.

Meanwhile, Chinese authorities have repeatedly vowed to provide a level playing field for foreign investors. Recent efforts have also been made to make the service industry more accommodating to foreigners, addressing concerns that it is sometimes less welcoming compared to other countries.

0 Comments