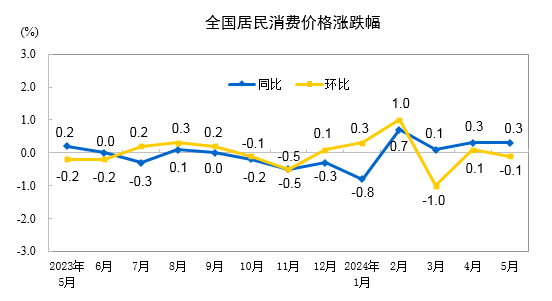

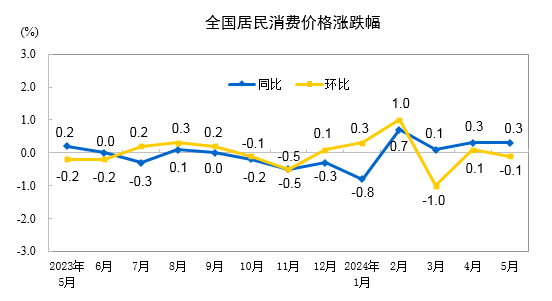

1.China’s Consumer Prices Rise 0.3% Year-on-Year in May 2024

In May 2024, national consumer prices rose 0.3% y-on-y. Among which, urban areas and rural areas rose by 0.3% and 0.4%; food prices fell by 2.0% and non-food prices rose by 0.8%; prices of consumer goods remained stable and prices of services rose by 0.8%. From January to May, the nation’s consumer prices increased by 0.1% on average compared to the same period of the previous year.

On a month-on-month basis, national consumer prices dropped by 0.1% in May. Among them, urban areas and rural areas decreased by 1.0% and by 0.1%; food prices remained stable while non-food prices dropped by 0.2%; consumer prices decreased by 0.1% while service prices increased by 0.1%.

In May, the price of food and tobacco dropped by 1.0% year-on-year, contributing to a decrease of approximately 0.28 percentage points in the CPI. Prices in the other seven major categories all rose on a year-on-year basis. Prices for other goods and services rose by 3.6%, education, culture, and entertainment by 1.7%, and clothing by 1.6%. Healthcare, household goods and services, and housing prices increased by 1.5%, 0.8%, and 0.2% respectively. In contrast, transportation and communication prices fell by 0.2%.

On a month-on-month basis, prices for food, tobacco, and alcohol remained stable. Among the seven other major categories, two saw increases, one remained flat, and four experienced declines. Clothing prices rose by 0.4%, and prices for other goods and services increased by 0.1%. Healthcare prices remained unchanged. Transportation and communication prices fell by 0.8%, household goods and services by 0.7%, and housing and education, culture, and entertainment prices both decreased by 0.1%.

Data Source: https://www.stats.gov.cn/sj/zxfb/202406/t20240612_1954519.html

2.Official Annoucement: EU to Impose Temporary Tariffs on Chinese Electric Vehicles Starting July 4?

On June 12, the European Commission announced that it will begin imposing temporary tariffs on Chinese electric vehicle (EV) imports starting July 4. BYD, Geely, and SAIC will face tariffs of 17.4%, 20%, and 38.1% respectively. Other Chinese automakers will be subject to an average tariff of 21%, while those that did not actively cooperate with the EU’s investigation will face a unified tariff of 38.1%.

Rhodium Group’s report suggests that the EU would need to raise tariffs to 40%-50% to offset the cost advantage of Chinese EVs. According to the China Passenger Car Association, China exported a total of 744,000 passenger cars to the EU last year, including 656,000 EVs, which account for about 40% of China’s total EV exports. Data from the European Automobile Manufacturers Association (ACEA) show that the EU registered a total of 10.547 million new passenger cars last year, with 2.352 million being new energy vehicles (NEVs). This means Chinese imports held a 7.06% market share for passenger cars and a 27.9% market share for NEVs in the EU. A report by Germany’s Kiel Institute for the World Economy (IfW) indicates that a 20% tariff could reduce China’s EV exports to the EU by a quarter.

Indeed, the European Commission stated in its announcement that it will first seek to negotiate with China over the issue of overcapacity. The tariffs will only be imposed on July 4 if negotiations fail. Additionally, the tariffs are temporary in nature. Both sides will have four months after July to negotiate and avoid the implementation of permanent tariffs. For the temporary tariffs to become permanent, the European Commission must reach an agreement with all 27 member states.

Glopen will continue to monitor the situation closely.

3.Moutai Prices Drop Below Key Threshold, Dealers Suspend Purchases

On June 11, the market price of Moutai was reported at CNY 2,445 per bottle, a decrease of CNY 75 per bottle compared to the beginning of the month, closing down 3.1%. This decline brought the total stock value below CNY 2 trillion, resulting in a loss of over CNY 60 billion. Over the past month, the wholesale price of loose bottles of Flying Moutai has decreased by approximately CNY 125 per bottle, with the rate of decline accelerating significantly.

It is important to note that CNY 2,500 represents the profit margin threshold for Flying Moutai dealers. As prices have fallen below this level, some dealers have indicated they are suspending the purchasing of all Moutai products.

Industry experts cite several underlying factors contributing to the ongoing decline in Moutai prices. In the short term, a discrepancy between supply and demand may result in a price reduction. The general public’s willingness, confidence, and ability to consume alcohol are on the decline, which is the primary driver of the downward price trend for Moutai.

Furthermore, a more optimistic view suggests that the short-term price cuts on Moutai and other liquors will have a relatively small overall impact on the liquor market. Instead, these cuts are more likely to affect expectations and future outlooks. Currently, they may impact dealer inventory, winery capital investment, and create divergence within the entire liquor industry. However, a more pessimistic perspective suggests that the short-term differentiation within the liquor industry will continue to intensify. Baijiu is not as popular among younger consumers. This will lead to varying growth patterns among liquor enterprises, affecting performance, inventory stability, sales promotion, and brand establishment.

As a barometer for the Chinese liquor industry, the fluctuating price of Moutai introduces a layer of uncertainty into the broader development of the liquor market.

4.UEFA European Football Championship 2024: The Business of Chinese Brands

This year’s Euro Cup is not just a football feast but also an excellent platform for Chinese enterprises to expand their overseas markets and promote their brands to foreign consumers.

A total of 13 companies have been selected as Official Global Sponsors for Euro 2024: Adidas, Sizzler, Alipay, Sourcing, Betano, Booking, BYD, Coca-Cola, Hisense, Lidl Supermarkets, Engelbert Strauss, Qatar Tourism, and Vivo. Among these sponsors are five Chinese brands: Hisense, Alipay, Vivo, AliExpress, and BYD. These five Chinese companies collectively represent over one-third of the official sponsors for Euro 2024, setting a new record for Chinese sponsorship at this tournament.

This year’s Euro Cup is notable for the continued influence of “Chinese technology.” The official ball of this year’s tournament will incorporate “microchip football” technology, enabling real-time transmission of impact location and timing information. This advancement aims to enhance the accuracy of handball and offside decisions. Additionally, VAR (Video Assistant Referee) technology will see a comprehensive upgrade, potentially resolving previously contentious issues related to handball and offside calls.

Cross-border e-commerce is also playing a significant role in the European economy this year. In March, UEFA officially announced that China’s AliExpress, a cross-border e-commerce platform under Alibaba Group, has become an official partner and the first e-commerce sponsor of Euro 2024.

5.Shenzhen Court Accepts Royole Corporation’s Bankruptcy Filing

Recently, the Shenzhen Intermediate People’s Court announced that it had officially accepted the bankruptcy liquidation case of Royole Corporation as of May 15, 2024. The company’s founder, Bill Liu, is famous for the fastest Chinese Ph.D. graduate in the history of Stanford University’s Department of Electrical Engineering.

As one of the early pioneers in flexible screen technology in China, Royole Corporation once attracted significant attention from over 20 prominent VC/PE firms and industrial capital investors, including IDG, CITIC Capital, and Shenzhen Capital Group. The company’s valuation at one point soared to over CNY 50 billion. Founded in 2012, Royole’s business focused primarily on the development and manufacturing of flexible displays and fully flexible sensors.

Within just two years, the company developed a flexible screen as thin as 0.01 millimeters, thanks to its proprietary Ultra-Low Temperature Non-Silicon Semiconductor Process (ULT-NSSP) technology. In 2020, Royole was ranked 12th on the “2020 China New Economy Unicorn 200 List” with a valuation of $6 billion and topped the “Top 100 Chinese Tech Innovation Companies” list by China Entrepreneur magazine. As Royole’s valuation climbed, Bill Liu made it onto the Hurun Rich List in 2020 with a personal wealth of CNY 14.5 billion, ranking 376th.

Royole’s failure is attributed to three critical strategic missteps:

- Low product yield rates and a lack of commercial viability

- The decision to adopt a capital-intensive model by building its own production line of smart phones, which put significant strain on its financial resources

- Management’s lack of clear market insight and judgment

0 Comments