1.Shanghai, Shenzhen, and Beijing Stock Exchanges Resume IPO Acceptance

Due to the sluggish market environment, the China Securities Regulatory Commission (CSRC) had tightened the pace of IPOs since August 27 last year. As of June 21, only five new companies have been accepted, while approximately 246 companies have voluntarily withdrawn their IPO applications, reducing the number of companies in the IPO queue to 431.

The Beijing Stock Exchange has done so after a three-month pause, while the Shanghai and Shenzhen exchanges have restarted IPO acceptance after a six-month hiatus.

The Beijing Stock Exchange’s website shows that on June 21, Chuangzheng Electric, Aomaisen, and Jinhua New Materials had their IPOs accepted. All three companies chose the first set of listing standards on the Beijing Stock Exchange, which is also the choice of over 90% of listed companies there. These standards require an estimated market value of no less than CNY 200 million, net profits of no less than CNY 15 million in the last two years with an average weighted return on equity of no less than 8%, or a net profit of no less than CNY 25 million in the last year with an average weighted return on equity of no less than 8%.

On the Shanghai Stock Exchange, the newly accepted IPO of Taijin New Energy is classified under the special equipment manufacturing industry. The company is mainly engaged in the R&D, design, production, and sales of high-end green electrolytic complete equipment, titanium electrodes, and metal glass sealing products. On the Shenzhen Stock Exchange, the newly accepted IPO of China Uranium is classified under the non-ferrous metal mining and dressing industry. The company is primarily involved in the mining, smelting, sales, and trade of natural uranium resources, as well as the comprehensive utilization and product sales of radioactive associated minerals such as monazite, uranium, and molybdenum.

The resumption of IPO acceptance does not equate to a significant increase in the number of IPO registrations. Therefore, this move will not substantially increase the number of IPO registrations in the short term and will have a limited immediate impact on the market. However, as the A-share market dips below 3,000 points, the resumption of IPO acceptance by the three major exchanges is expected to have a positive impact on short-term market investment confidence and sentiment.

2.Chinese Business Owners Face Significant Back Taxes Amid 30-Year Tax Survey

Bohui, a company manufacturing biomedical products, recently announced the temporary suspension of its environmental protection aromatic oil production unit and related ancillary equipment following a tax bureau notice regarding tax matters. The notice requires the production of “heavy aromatic hydrocarbon derivatives” to be taxed under “heavy aromatic hydrocarbons.” Consequently, Bohui has been issued a demand for CNY 500 million in back taxes, leading to an immediate shutdown of its production.

Meanwhile, VVfood disclosed that it had received a Notice of Tax Matters from the Development Zone Taxation Sub-bureau of the State Administration of Taxation of Zhijiang City. This notice, forwarded by its subsidiary Hubei Zhijiang Liquor Company Limited, outlined approved taxable expenses for Zhijiang Liquor from January 1, 1994, to October 31, 2009, totaling CNY 85 billion. In the previous financial year, VVfood reported a net profit of approximately CNY 200 million. This retroactive tax payment represents a substantial loss, amounting to nearly half of last year’s profits.

The State Administration of Taxation (SAT) of China has stated that the recent tax investigations and reimbursements are routine activities conducted in accordance with legal and regulatory requirements.

However, these back tax incidents have sparked significant market concern. The rationale behind these decisions is twofold: firstly, local revenue deficits have emerged after the exhaustion of land sale proceeds. Secondly, the advent of big data has enhanced the efficiency of tax collection and administration. In the past, manual processes risked oversight, but the current reliance on data allows for more effective and efficient investigations into tax evasion.

3.Audi A4L Base Price Falls Below CNY 200,000, Signaling Major Shift in Luxury Car Market

The base price of the Audi A4L, a top-tier B-segment luxury sedan, has dropped below the CNY 200,000 mark, challenging previous price perceptions among consumers and industry insiders. This represents a reduction of up to CNY 120,000 on the entry model, the Audi A4L 40 TFSI Fashion Dynamic, which originally had a MSRP of CNY 321,800. Following the BMW i3, the Audi A4L is the next model to see its price fall below CNY 200,000. Despite joint-venture car price cuts failing to stimulate sales, the strategy has now been applied to Audi.

For luxury car brands such as Audi, Benz, and BMW, these price cuts reflect a lack of confidence in the market. This situation arises from the brands’ inability to sustain the high premium prices of the past. Significant price reductions by luxury car brands, declining sales of joint-venture vehicles, and intense competition from new energy vehicles collectively indicate that the market is competitive and brands must work hard to succeed.

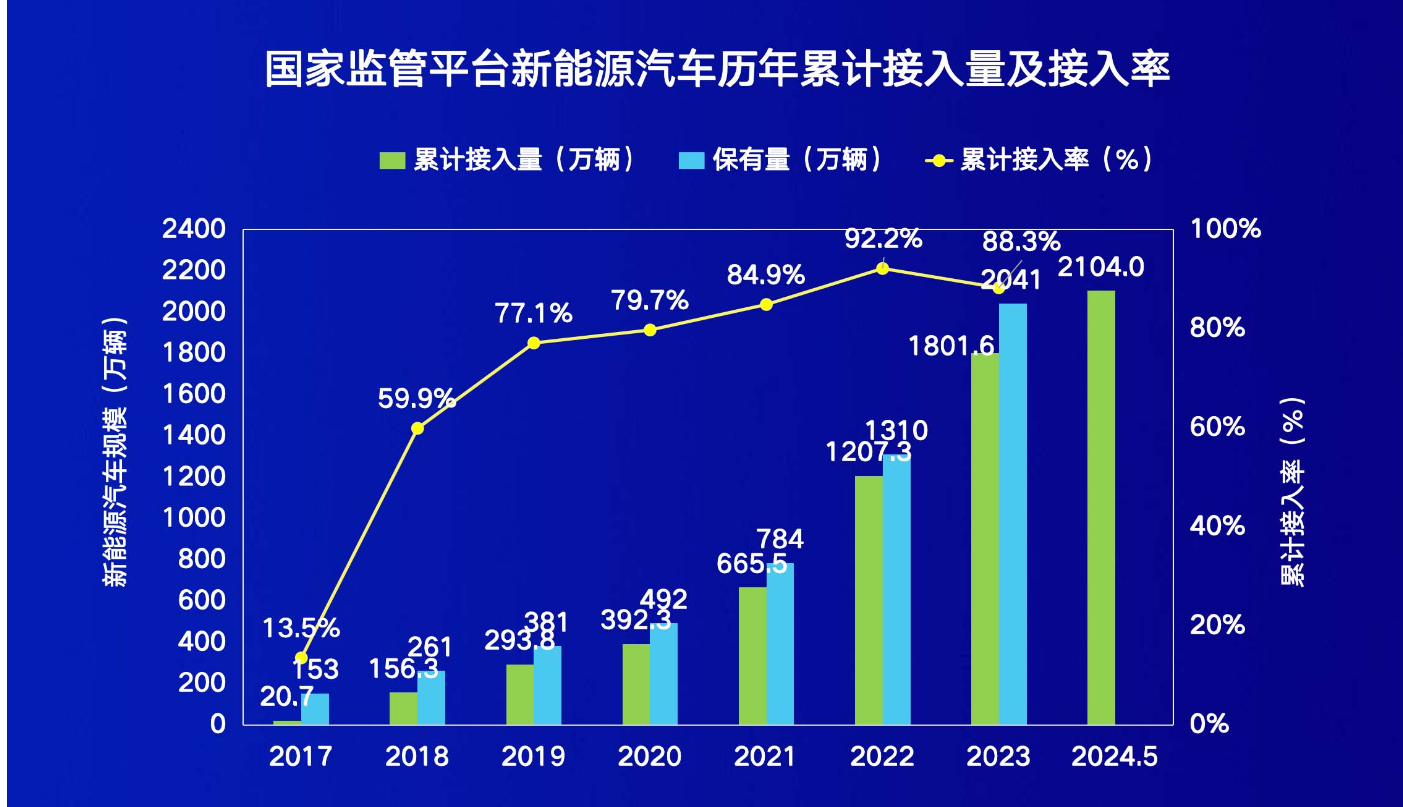

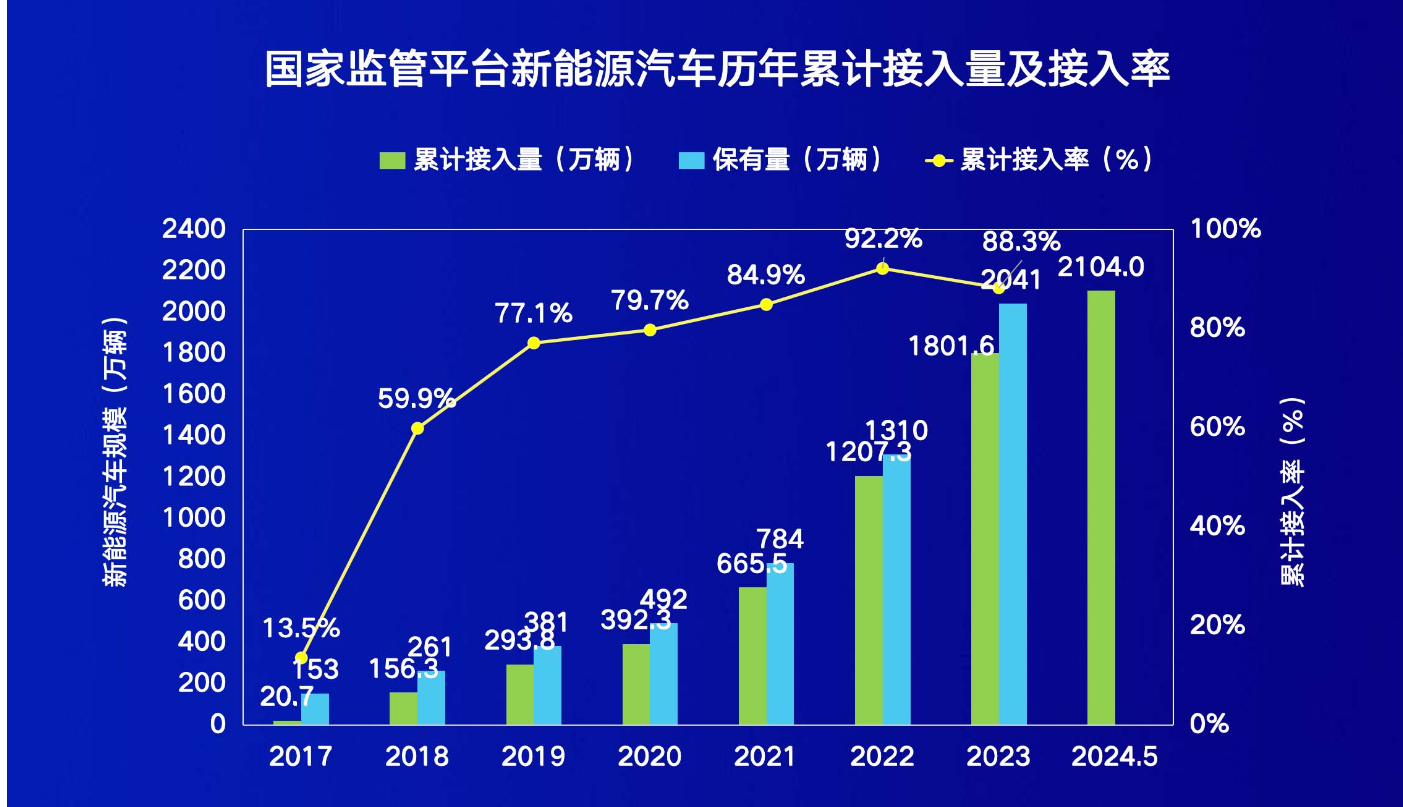

According to data from the China Association of Automobile Manufacturers (CAAM), sales of Chinese brand vehicles reached 11.496 million units from January to May 2024, marking an 8.3% year-on-year increase. Among these, sales of new energy vehicles (NEVs) amounted to 3.895 million units, a 32.5% year-on-year growth, with a market share of 33.9%. In contrast, mainstream joint-venture brands saw retail sales of 490,000 units, a 21% year-on-year decrease, though they achieved an 8% month-on-month growth.

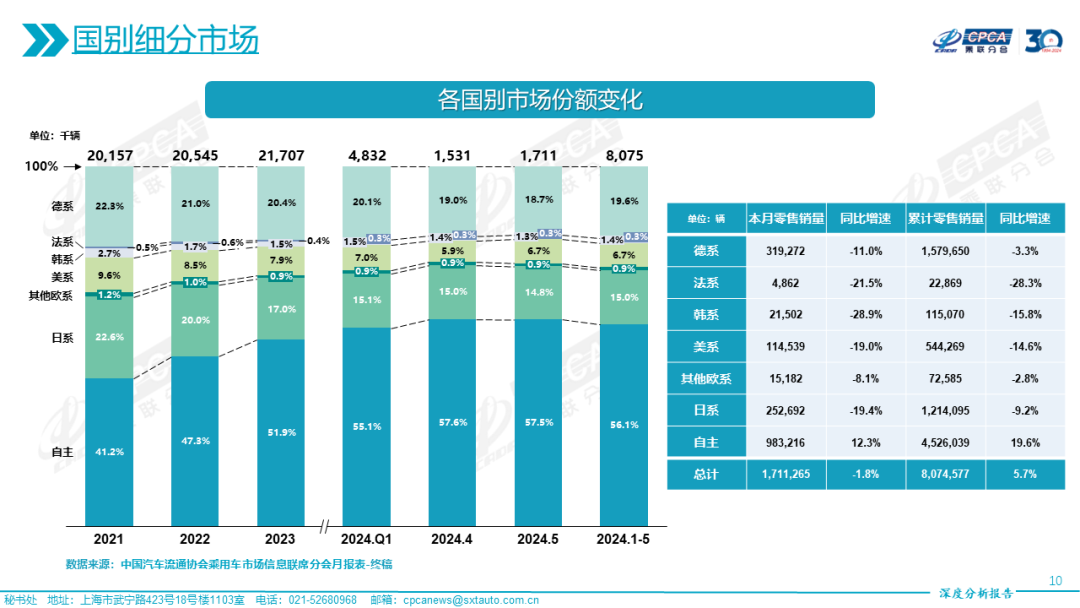

Based on sales volume, German brands’ retail share in May was 18.6% with the y-o-y growth rate of -11.0% , while Japanese brands held a 14.8% share with a y-o-y growth rate of -19.4%. American brands accounted for a 6.7% market share with a y-o-y growth rate of -19.0%.

4.Honor of Kings International Version Launches in Southeast Asia, North America, Europe, Japan, South Korea, and Latin America

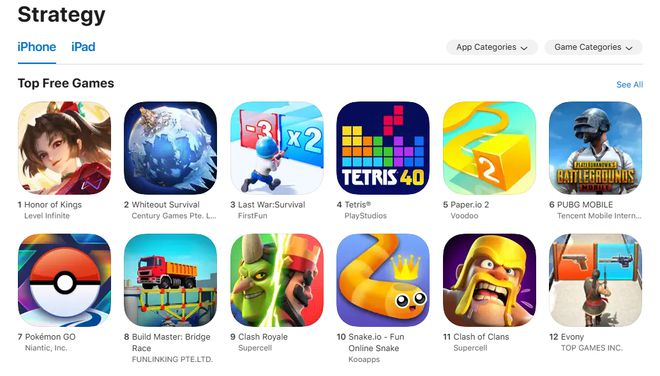

On June 20, Honor of Kings, the international version of the popular game, was launched in Southeast Asia, North America, Europe, Japan, South Korea, and Latin America, marking a significant step in its global expansion. Since its initial launch in Brazil in March, the game has successfully debuted in over 50 countries and regions, including Indonesia, the Philippines, Canada, and Australia. The game has topped the free charts in 12 countries, including Indonesia, the Philippines, the United States, Canada, and Australia.

Honor of Kings maintains a high degree of consistency with its Chinese version in terms of UI, game mechanics, hero characters, skills, and equipment. However, Tencent has made several localization adjustments to cater to different global markets. These include download optimizations to accommodate varying network conditions overseas, making the game less burdensome. Additionally, dedicated servers have been set up in multiple regions worldwide to ensure low latency and optimal game performance.

With its global launch, Honor of Kings is poised to become a strong competitor to League of Legends, indicating Tencent’s competitive advantage in the mobile game sector. The success of Honor of Kings on an international scale could solidify Tencent’s position as a dominant player in the global mobile gaming industry?

5.Incident at Manner Coffee Sparks Customer Dissatisfaction Amid Rapid Expansion

On June 17, a clerk at Manner Coffee’s 716 Weihai Road shop in Shanghai threw coffee powder in a customer’s face during a dispute, shouting, “You complain!” This incident has led to widespread dissatisfaction among Chinese customers regarding the quality of service at Manner Coffee.

A Manner Coffee representative stated, “This is a matter that we will address promptly and seriously. We became aware of the situation late last night. We can confirm that the partner in the shop was changed today.”

Despite surveillance footage of the incident, it was noted that there were two clerks on duty at the time. Some consumers have provided feedback indicating a reduction in the number of clerks compared to previous periods. When there is only one clerk on duty, whether in-store or online, it becomes challenging to provide a seamless customer experience. From making coffee to packing orders, the clerk often becomes overburdened, leading to a lack of customer engagement.

Several Manner baristas have taken to social media to express grievances about working conditions. They reported that the full attendance bonus of CNY 1,000 is deducted for lateness and personal leave. Additionally, employees are expected to produce 500 cups of coffee in an 8-hour shift. They also mentioned that the internship period lasts 1-2 months, with a remuneration of CNY 4,000.

In contrast, Manner Coffee’s shop expansion in 2023 has accelerated rapidly. The company opened its 1,000th directly-managed shop on the North Bund in Shanghai on October 30, 2023, achieving this milestone ahead of schedule and exceeding its annual expansion target. The following day, Manner announced that the 1,100th shop was approaching, and a month later, it revealed plans to open its 1,200th shop nationwide, further increasing its scale.

0 Comments