1.China’s Foreign Exchange Market Transactions Totaled CNY 23.89 Trillion in May 2024

According to the State Administration of Foreign Exchange on June 28, China’s foreign exchange market (excluding the foreign currency pair market) recorded a total transaction volume of CNY 23.89 trillion (equivalent to USD 3.36 trillion) in May 2024.

Of this, transactions in the bank-to-customer market amounted to CNY 3.16 trillion (equivalent to USD 0.45 trillion), while the interbank market transactions reached CNY 20.72 trillion (equivalent to USD 2.92 trillion). The spot market saw cumulative transactions of CNY 7.81 trillion (equivalent to USD 1.10 trillion), and the derivatives market recorded cumulative transactions of CNY 16.08 trillion (equivalent to USD 2.26 trillion).

From January to May 2024, the cumulative transaction volume of China’s foreign exchange market totaled CNY 113.09 trillion (equivalent to USD 15.92 trillion).

Data Source: http://m.safe.gov.cn/safe/2024/0628/24677.html

2.OpenAI Has Announced The Termination of Services to China

Since June 24, OpenAI has announced the termination of API services to China. Starting from July 9, OpenAI will block API traffic from unsupported countries and regions. Organizations wishing to continue using OpenAI’s services must access them from within supported countries or regions. This development poses significant challenges for many users and companies in China that rely on the OpenAI API.

Additionally, companies that had planned to build their businesses around OpenAI’s large models now face an extra hurdle. Without a timely alternative, numerous companies lacking core technology will be forced out of the market.

OpenAI had initially restricted registration of phone numbers from China. As a result, many users and businesses constructed servers outside of China to access the service. Given OpenAI’s status as a leading AI service provider, Chinese users likely generate substantial data. If OpenAI is unable to establish a data centre in China, as Apple and Tesla have done, it may be used by individuals or entities with malicious intent to conduct activities that are detrimental to China.

Conversely, this move by OpenAI might prompt Chinese companies to turn to domestic AI models, potentially boosting the utilization of China’s leading AI technologies.

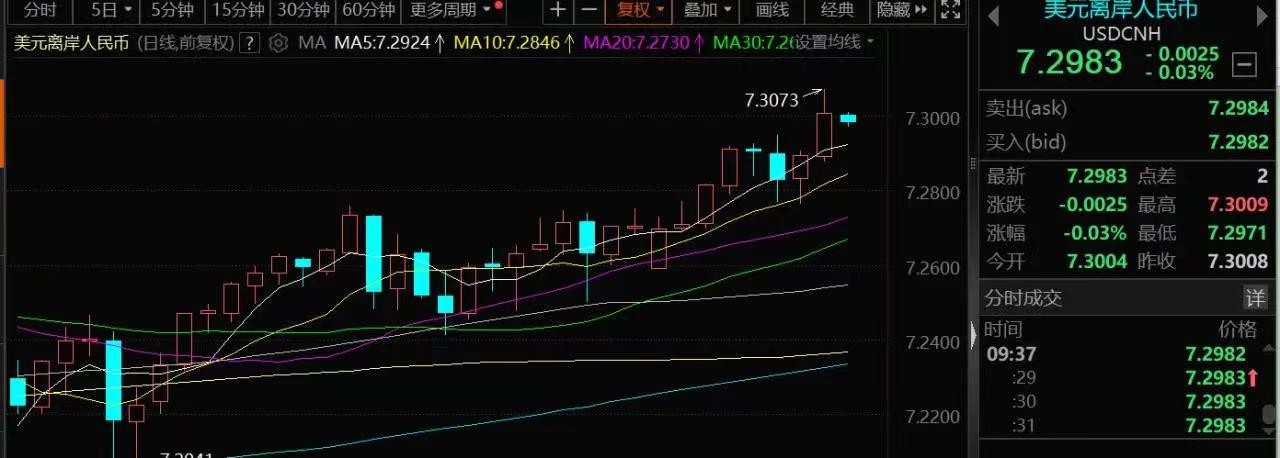

3.Chinese Yuan Hits Yearly Low Amid Strong US Jobs Data and Geopolitical Tensions

As of 9:30 a.m. on June 25, the U.S. dollar was trading at 7.2983 against the offshore yuan. The Chinese yuan has reached a yearly low, driven by strong U.S. jobs data that led the Federal Reserve to slow its pace of rate cuts.

Several overseas investment institutions have indicated that the current yuan exchange rate has reached a low point for the year, closely related to recent changes in international geopolitical risks. Notably, the significant increase in seats held by far-right political parties in the European Parliament has raised market concerns about Europe’s future direction. This has reduced the appetite for risk among financial capital, leading to withdrawals from emerging markets and other high-risk assets. Additionally, the European Central Bank’s rate cuts ahead of the Federal Reserve have widened the dollar’s spread advantage. This has resulted in a substantial influx of European and American capital into the dollar, with many investors short-selling emerging market currencies, including the yuan. Furthermore, the intensification of the Palestinian-Israeli conflict and the Russian-Ukrainian conflict, combined with an unexpected decline in safe-haven assets like gold during the Dragon Boat Festival, has driven European and American capital to favor U.S. debt as a safe haven. Consequently, funds have flowed rapidly from emerging markets into the U.S. debt assets, contributing to the yuan’s decline.

Industry experts suggest that the current yuan exchange rate is relatively low. China’s relevant departments possess more effective exchange rate stabilization tools than other countries, allowing for more efficient intervention in the currency market.

By June 27, the U.S. dollar was trading at 7.1270 against the offshore yuan.

4.Liaoning Agricultural and Commercial Bank to Absorb 36 Rural Banks Amid Regulatory Overhaul

Thirty-six small and medium-sized rural banks in Liaoning have announced their dissolution and absorption by Liaoning Agricultural and Commercial Bank. This follows the bank’s merger with 30 agricultural credit cooperatives last year, meaning that Liaoning Agricultural and Commercial Bank will integrate more than 60 banks within a little over a year.

At last year’s Central Financial Work Conference, the Chinese government proposed implementing strict entry standards and regulatory requirements for small and medium-sized financial institutions, as well as promoting specialized local operations. The goal was the “timely disposal of risks of small and medium-sized financial institutions.”

The rationale behind this decision is clear: small and medium-sized banks, particularly in rural areas, often lack sufficient risk resistance and are plagued by significant operational chaos. Originally established to serve farmers and agriculture, these rural financial institutions have faced numerous challenges over time.

The primary risks are twofold:

1. Inadequate Internal Controls: Major shareholders often exploit these banks as personal ATMs. For example, Jinzhou Hengsheng Village Bank was defrauded of over CNY 2.6 billion in loans by shareholders and other individuals, with nearly CNY 1.2 billion still outstanding.

2. Operational Irregularities: These include equity pledges and breaches of trust by equity pledgers, which have led to significant operational risks.

By consolidating these rural banks, Liaoning Agricultural and Commercial Bank aims to mitigate these risks and stabilize the regional financial landscape.

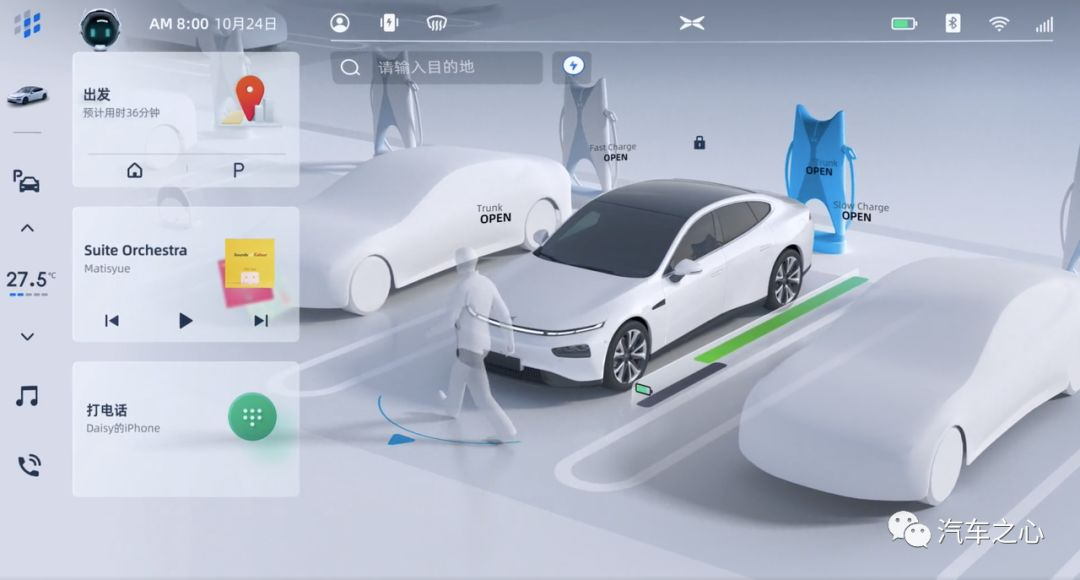

5.Xiaopeng’s Autonomous Driving Chief Highlights Challenges and Market Expansion Amidst Growing Competition

In a Weibo post on June 27, Li Liyun, head of Xiaopeng’s autonomous driving division, addressed the challenges posed by the country’s 300 million electric motorbikes and compared China’s road conditions to the more complex infrastructure of the United States. One of the most pressing issues is the lack of dedicated lanes for non-motorized vehicles. Li emphasized that the Xiaopeng XNGP, set for full release in July, is poised to achieve true nationwide availability and aims to enhance the daily travel experience through a positive intelligent driving experience.

Despite China’s intelligent driving industry still being in its early stages, Xiaopeng is determined to gain a competitive edge through rigorous participation in the market. The Xiaopeng XNGP has undergone extensive testing in cities such as Nanning, Guangzhou, Kunming, and Nanchang, including performance evaluations involving motorcycles. This comprehensive testing has allowed the company to better understand the challenges faced by motorcycle riders and incorporate solutions into the vehicle’s design. Xiaopeng aims to deepen its understanding of the Chinese market and establish a distinctive brand identity in the autonomous driving sector.

The autonomous driving industry in China is crowded with professional players like Baidu Apollo and Pony.ai, as well as solution providers such as Dexerials, Horizon, and Black Sesame. Additionally, major companies like NIO, Li Auto, Huawei, Xiaomi, BYD, Great Wall, Geely, Toyota, and Volkswagen are all heavily invested in this field. A robust autonomous driving system will be a crucial factor for car companies to succeed in the competitive smart electric vehicle market.

Currently, Tesla holds a significant advantage over traditional car manufacturers due to its unique market position. Tesla’s full-stack self-developed chip, extensive data, and unmatched algorithmic capabilities set it apart. However, one drawback of Tesla’s Full Self-Driving (FSD) system is its slow entry into the Chinese market.

Against this backdrop, Xiaopeng is once again challenging Tesla’s market dominance.

0 Comments