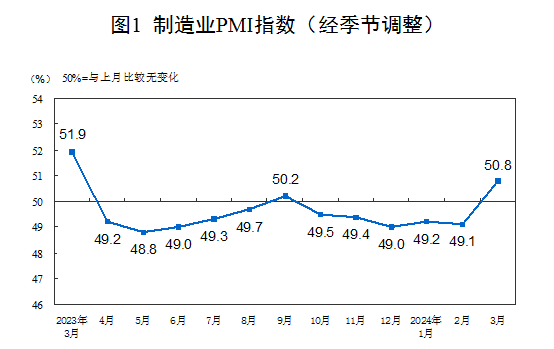

1.China’s Official Manufacturing PMI Hits 50.8 in March, Returning to Expansion for the First Time in the Past Half Year

According to the data released by National Bureau of Statistics on March 31st, in March, the Manufacturing Purchasing Managers’ Index (PMI) was 50.8%, an increase of 1.7 percentage points from the previous month and above the critical threshold, indicating a rebound in manufacturing sector activity.

When viewed by company size, the PMI for large enterprises was 51.1%, an increase of 0.7 percentage points from the previous month; the PMI for medium-sized enterprises was 50.6%, growing 1.5 percentage points from the previous month; the PMI for small enterprises was 50.3%, up 3.9 percentage points from the previous month. All PMIs for enterprises of varying sizes surpassed the critical threshold.

Looking at the sub-indices that comprise the manufacturing PMI, the production index (52.2%), supplier delivery time index (50.6%), the new orders index (53.0%), employment index (48.1%), and raw material inventory index (48.1%), rising by 2.4 percentage points, 1.8 percentage points, 4.0 percentage points, 0.6 percentage points, and 0.7 percentage points from the previous month, witnessed a rebound in the market demand level for the manufacturing sector with a slight improvement in devliery times and in the employment climate.

In March, the non-manufacturing business activity index was 53.0%, an increase of 1.6 percentage points from the previous month, above the critical threshold.

In March, the Composite PMI output index, which reflects the changes in the output in current period of the entire industry (manufacturing and non-manufacturing industries), was 52.7%, an increase of 1.8 percentage points from the previous month, above the critical threshold, indicating an accelerated expansion of production and business activities among Chinese enterprises.

Data Source: https://www.stats.gov.cn/sj/zxfb/202403/t20240329_1954065.html

2.Alibaba to Integrate 1688 Platform with Taobao, Launching Dedicated Channel for Curated Source Factory Products

Sources from Alibaba reveal that on March 25th, the 1688 platform, Alibaba’s B2B sector, made a strategic move to integrate comprehensively with Taobao, which is 2C platform. This integration aims to provide small and medium-sized enterprises with efficient and convenient transaction services. As a result, millions of manufacturers from 1688 will directly supply their products to the Taobao marketplace.

Examining the evolution of China’s e-commerce sector shows that shifts in the market are closely linked to changes in consumer demands. In the current economic climate, where consumers are cutting back on spending, e-commerce platforms are increasingly competing based on price and service quality. With its extensive network of manufacturers and high-quality product offerings, 1688 is poised to address these consumer needs effectively. By bringing these high-quality goods directly to Taobao, 1688 offers consumers more affordable options and opens up new avenues for manufacturers to market their products.

However, 1688’s strategy extends beyond market expansion; it reflects a nuanced understanding and anticipation of market trends. E-commerce entities have prioritized attracting young shoppers, with the 1688 app gaining popularity among this demographic and topping the AppStore shopping category. The app, along with its strategies and tips, has gained traction on various social media platforms, highlighting a trend towards wholesale purchasing among consumers.

This strategic move by Alibaba is seen as a crucial advancement in unifying the e-commerce landscape, potentially enhancing the overall ecosystem and offering new prospects for small and medium enterprises. Nevertheless, this integration entails addressing several technical, operational, and managerial challenges. Ensuring product quality, enhancing customer service, and safeguarding consumer rights are critical issues that need attention, underscoring the dual nature of this development as both an opportunity and a challenge.

3.Horizon Robotics, A Chinese Innovator in Autonomous Driving Software, Seeks IPO in Hong Kong

On March 26th, 2024, Horizon Robotics, a premier provider of advanced driver-assistance systems (ADAS) and autonomous driving (AD) technologies for passenger vehicles, initiated an IPO filing with the Hong Kong Stock Exchange. This esteemed provider, offering pivotal in-car technologies to top automakers such as Volkswagen and BYD, has been recognized by CIC as China’s foremost company in delivering comprehensive ADAS and AD solutions since its widespread implementation in 2021, leading in annual installation volume.

As of the most recent practical date, Horizon’s integrated solutions have been adopted by 24 OEMs, encompassing 31 different brands, and are featured in over 230 car models. The company’s technologies have been chosen by all of China’s top 10 OEMs for mass incorporation into their passenger vehicle lines. In 2023, Horizon achieved a significant milestone by securing over 100 new design awards for various car models. With a substantial and diverse customer portfolio that includes top-tier OEMs and suppliers globally, Horizon Robotics has seen remarkable growth, leveraging its market leadership amidst the burgeoning demand for autonomous driving tech.

This IPO move aims to harness the growing global appetite for autonomous driving innovations. By the end of 2022, Horizon reached a $8.7 billion valuation following a $210 million Series D funding. Stake details revealed in their prospectus show investments from China’s SAIC, Volkswagen, and BYD at 10%, 2.6%, and 0.1%, respectively. The company’s 2023 revenues surged to nearly CNY 1.6 billion ($220 million), a significant rise from CNY 906 million the year before, with a notable reduction in net losses. Holding a 21.3% market share in China’s ADAS domain as of last year, Horizon stands as the country’s one of the leading providers. With the backing of investors like Sequoia Capital China and Hillhouse Investment, Horizon plans to channel its IPO proceeds into expanding its footprint in international markets, including Japan, Korea, and Europe.

4.Xiaomi Received Orders for Over 50,000 Cars within 27 Minutes of Launch

On the evening of March 28, during the Xiaomi Automobile Conference, Lei Jun, the Chairman of Xiaomi Group, revealed the prices for the Xiaomi SU7 models, which appearance indeed bears a strong resemblance to Porsche. The prices are set at CNY 215,900 for the Standard Edition, CNY 245,900 for the Pro Edition, and CNY 299,900 for the Max Edition. Remarkably, within just 27 minutes of its release, orders for the vehicle surpassed 50,000 units, as per the initial data shared officially.

The strategy to build anticipation and then surprise the market with lower-than-expected pricing seems to be working effectively, signaling a great value proposition.

In his presentation, Lei Jun drew comparisons between the Xiaomi SU7 and renowned brands like Porsche and Tesla, asserting that despite the Xiaomi car’s high-end features, it remains affordably priced. He praised Tesla for its pricing strategy and energy efficiency, while also noting that Xiaomi needs to increase its battery capacity to extend the vehicle’s range, a move reminiscent of Xiaomi’s previous competitive strategies, notably against iPhone.

Lei Jun aims to establish Xiaomi vehicles as a cost-effective alternative to luxury brands like Porsche and Tesla. However, given the challenges of ensuring the first series of cars are devoid of any defects, it is essential for Xiaomi to swiftly address any issues that emerge with these initial deliveries to maintain customer satisfaction and trust.

5.According to the Hurun Research Institute’s Global Rich List, Mumbai has overtaken Beijing as the City in Asia with the most Billionaires

According to the Hurun Research Institute’s list of the world’s wealthiest individuals by 2024 on the 27th, New York has the highest number of billionaires in the world with 119, followed by London with 97 billionaires. Mumbai, India’s top city, has surpassed Beijing and ranks third with 92 billionaires, making it the Asian city with the largest number of billionaires. Beijing, Shanghai, Shenzhen, and Hong Kong in China ranked fourth through seventh, while Moscow in Russia was eighth. New Delhi, the capital of India, ranked ninth, marking its first appearance in the top 10 on the list.

China remains at the top of the country rankings with 814 billionaires, despite having 155 fewer billionaires than the previous year. The U.S. follows with 800 billionaires, and India ranks third with 271. Mukesh Ambani, leading India’s Reliance Industries, stands as Asia’s wealthiest individual, positioned 11th worldwide with a net worth of $110 billion. Gautam Adani also made headlines by temporarily surpassing Ambani as Asia’s richest earlier in the year.

The Indian press has celebrated these findings, with The Indian Express and WION highlighting them as indicators of India’s escalating economic clout and rising global economic stature. Nonetheless, caution is advised by figures like Raghuram Rajan, the ex-governor of the Reserve Bank of India, who warns against complacency amidst India’s economic growth. In a recent interview, Raghuram Rajan, former governor of the Reserve Bank of India, cautioned against India’s overconfidence in its strong economic growth.

0 Comments