When trying to understand where e-commerce is headed, China is one of those eye-opening places to start.

China’s e-commerce platforms offer valuable insights into how digital experiences, content, and logistics can work together to shape buying behavior. Many from China’s e-commerce industry function quite differently from those you find elsewhere.

In this guide, we’ll break down six popular players in China, how each one operates, and why they’re worth paying attention to.

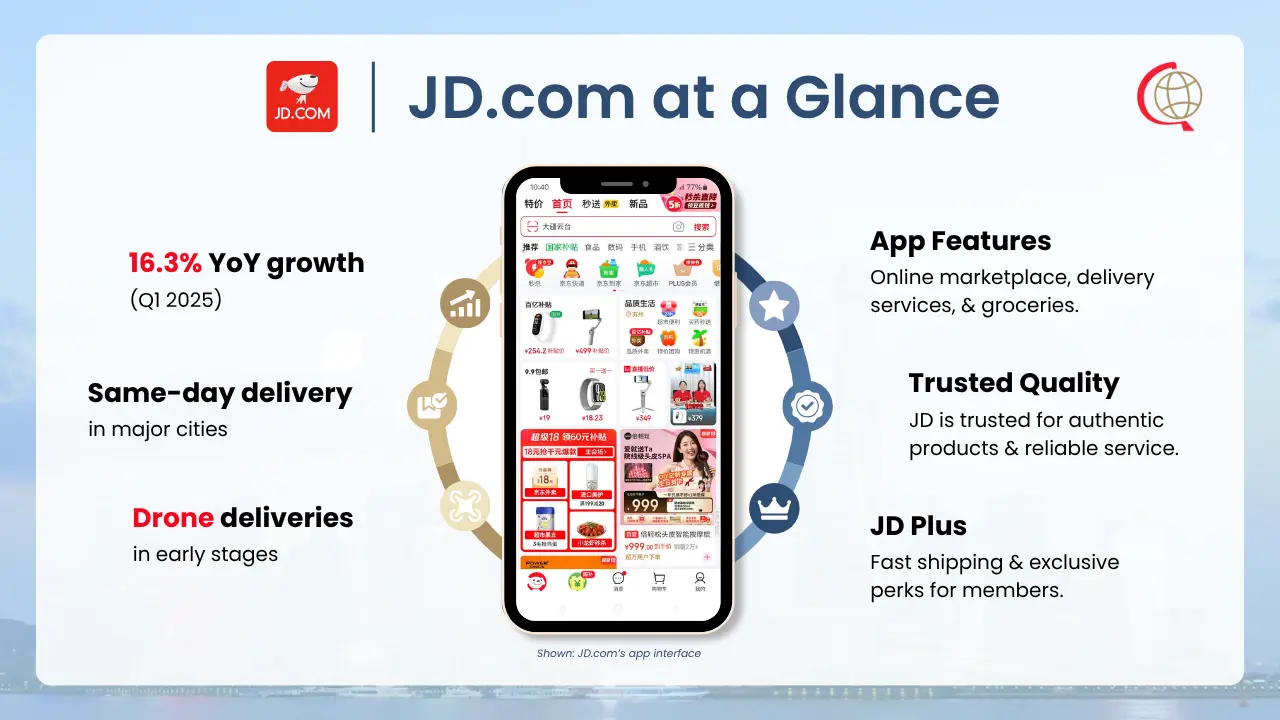

1. JD.com: Speed, Trust, and Quality Control

Known for: First-party logistics and fast, reliable delivery

Think of JD.com as China’s equivalent to Amazon—but with even tighter control over logistics and product quality. In Q1 2025, JD Retail saw a 16.3% YoY increase in net revenue, signaling strong consumer trust and consistent demand.

JD stands out from other platforms because it doesn’t just host third-party sellers—it also sells products directly to consumers. Instead of relying solely on external merchants, JD buys inventory from brands and handles storage, packing, and delivery through its own logistics network, JD Logistics.

This level of control allows JD to guarantee faster shipping and better quality assurance. Shoppers in major cities can often receive their orders the same day or the next, even for large items like TVs and refrigerators. Because of this reliability, JD is especially popular among consumers shopping for electronics, appliances, and personal care items who prioritize trust and fast delivery.

Its premium membership, JD Plus, mirrors Amazon Prime with perks like faster shipping and exclusive discounts. JD is also raising the bar in logistics by launching routine drone deliveries in cities like Guangzhou, Suzhou, Chongqing, and Shenzhen.

In an industry where authenticity and speed are crucial, JD shows how logistics can be the differentiator.

2. Taobao & Tmall: Alibaba’s Dual Engines for Online Retail

Known for: Massive scale, entertainment-driven shopping, and brand flagship stores

Alibaba’s e-commerce dominance is built on two distinct platforms: Taobao (a vast C2C marketplace) and Tmall (a premium B2C space for official brands). Taobao itself has reached over 910 million monthly active users. And based on recent GMV rankings, they both process more transactions than any other e-commerce ecosystem globally.

You can access both platforms directly within the Taobao app, which is renowned for its massive shopping festivals and booming livestream commerce.

According to Alibaba’s 2025 6.18 festival performance, 453 brands surpassed CNY 100 million ($14 million) in GMV, and 81 livestream channels crossed that same threshold.

Alibaba’s loyalty program, 88VIP, has now exceeded 50 million members, unlocking perks across shopping, entertainment, and daily services.

Compared to JD, Alibaba leans more on seller variety, while JD focuses on electronic gadgets and logistics. But the real advantage lies in Alibaba’s integrated online shopping ecosystem. With Alipay for payments and Cainiao for logistics, the company is able to create a seamless, immersive commerce experience that few can match.

3. Alipay: The Payment Backbone of Chinese E-Commerce

Known for: Powering digital payments and essential life services

Alipay is China’s leading digital wallet—think PayPal or Apple Pay, but with more functions. It powers transactions across platforms like Taobao and Tmall, holding a 75% share of their online payments.

It also supports international users. If you’re visiting China, you can use your overseas bank cards from major networks (e.g., Visa, Mastercard, JCB, Diners Club, and Discover) directly through Alipay.

With 1.04 billion monthly active users, Alipay is more than just a way to pay. Its massive reach is driven in part by its support for cross-border payments, making it the go-to method for Chinese tourists traveling abroad. In 2025 alone, Alipay processed an astonishing CNY 144.2 trillion ($20.1 trillion) in transactions.

Different sources offer varying figures on whether Alipay or WeChat Pay holds the largest domestic market share. However, it’s observed that WeChat Pay is used more frequently in daily life. Alipay, on the other hand, sees larger average monthly payments, with users spending around 2.3 times more per month than WeChat Pay users.

Beyond payments, Alipay offers a full ecosystem of services:

- Daily-life needs like utility bills, public transport, and hospital appointments

- Financial tools including investment funds, digital gold, and savings management

- Government services such as social security inquiries and tax processing

- Credit services to access small loans or build a digital credit profile

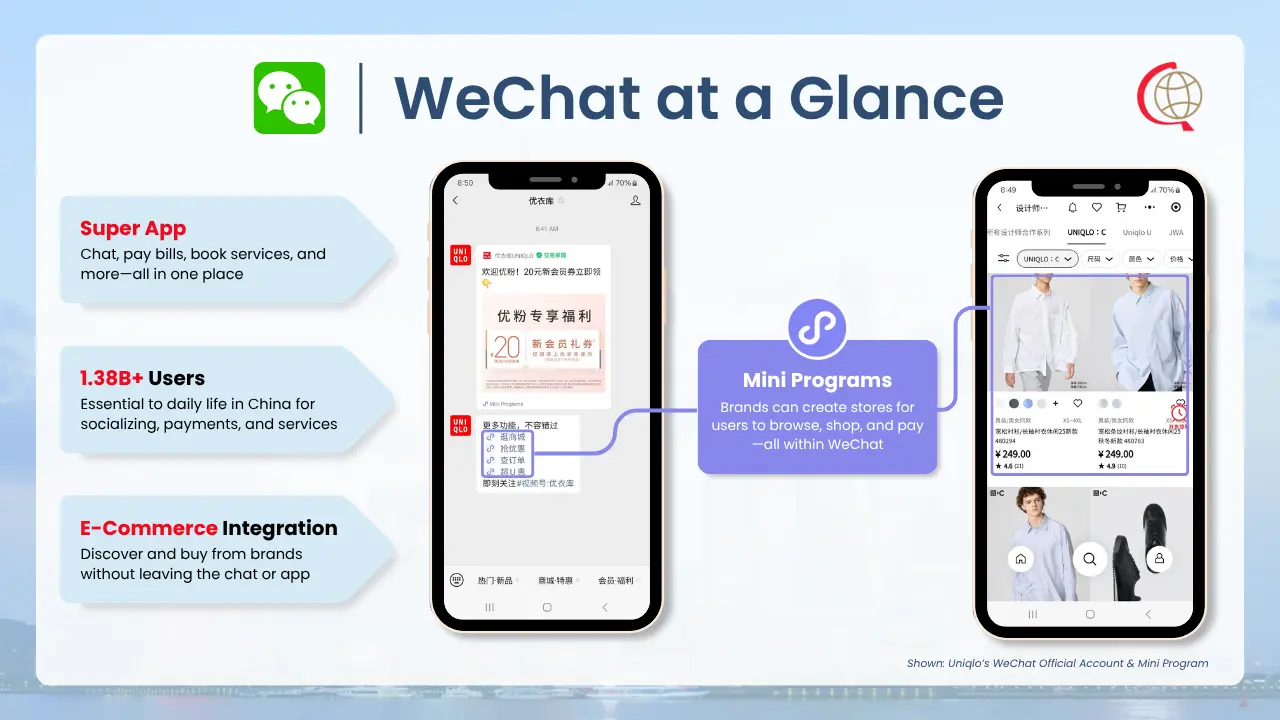

4. WeChat: Social Messaging with Built-In Shopping

Known for: Enabling commerce through messaging, payments, and Mini Programs

WeChat isn’t a traditional e-commerce platform. It started as a messaging app, but today it’s arguably China’s most integrated digital ecosystem. It’s widely used in China for chatting, paying bills, reading news, booking doctors, and more.

With over 1.38 billion users, it plays a central role in communication, payments, and media in daily life. And while it doesn’t offer the typical shopping homepage you find in JD.com or Taobao, e-commerce is still deeply embedded thanks to Mini Programs.

Mini Programs are lightweight apps that run inside WeChat without requiring downloads. You can use them for everything from life services and government tasks to even buying movie tickets. They’re commonly used in daily life for transportation and financial management, but mobile shopping is a large use case too.

In 2024, Mini Programs reached 949 million users with a 3% year-on-year increase. Brands use Mini Programs and official accounts to build their own stores, promote products, and offer support all within the WeChat ecosystem.

WeChat isn’t a traditional e-commerce platform. It began as a simple messaging app, but today it’s arguably China’s most integrated digital platform. With over a billion users, it plays a central role in communication, payments, and media in daily life. What’s less obvious is how commerce fits into that ecosystem.

WeChat proves that in China, e-commerce doesn’t have to be a dedicated shopping platform, but rather a smart integration into the apps people already use every day.

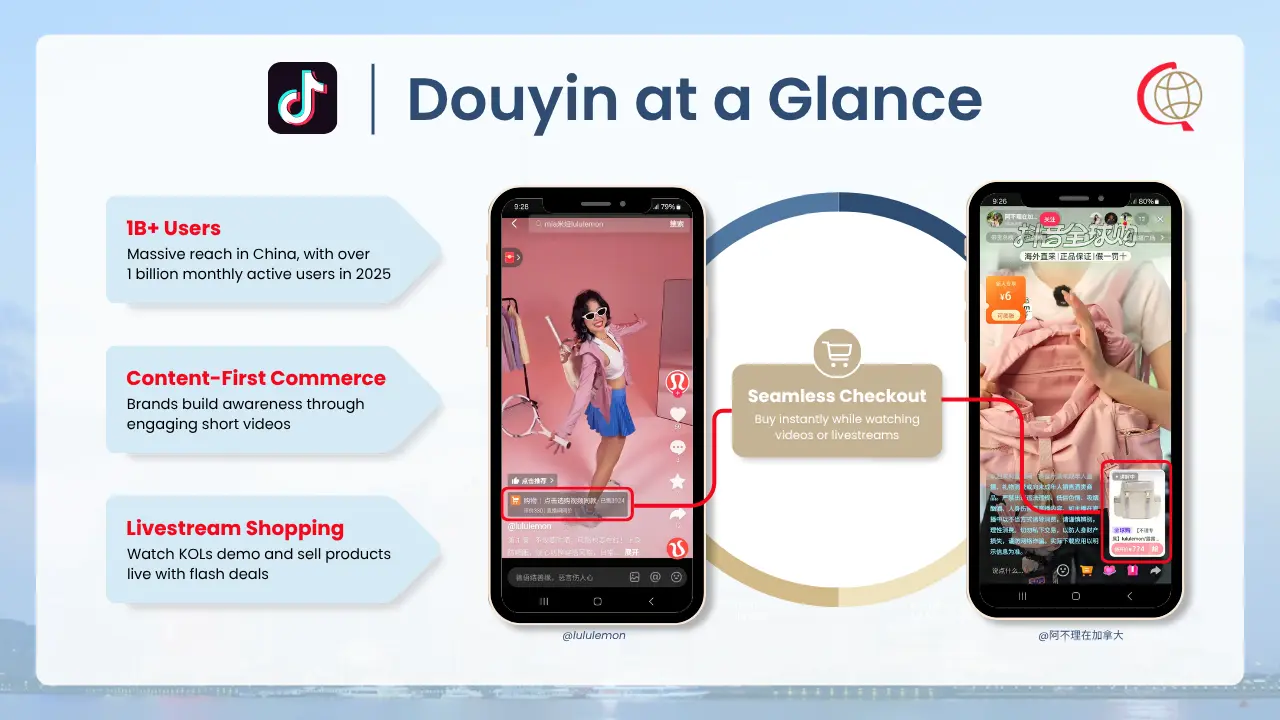

5. Douyin: Short Videos & Livestream Selling

Known for: livestream commerce and content-driven discovery shopping

Many know Douyin as the Chinese counterpart to TikTok. While both are developed by ByteDance, Douyin serves the mainland China market, and TikTok caters to users globally. Though they look alike, Douyin’s e-commerce functionalities are more mature.

In 2025, Douyin (including its lite version) reached 1.001 billion monthly active users, demonstrating massive market penetration. It’s one of China’s largest ecommerce players, generating roughly CNY 3.5 trillion ($487 billion) in GMV in 2024, up 30% year-over-year.

Unlike traditional platforms where consumers search for products, Douyin focuses on discovery-based shopping where users find products through engaging short videos and livestreams. This immersive approach has driven impressive results. Just as how many brands did well on Taobao and Tmall during the 6.18 festival, over 60,000 brands doubled their sales on Douyin year-over-year.

While browsing the app, you’ll realize that influencers form the core driver of Douyin’s sales, especially through livestream sales where they host live product demos and promote flash deals. TikTok is building a similar ecosystem to Douyin with TikTok Shop and Fulfilled by TikTok. But it’s still developing, especially outside Southeast Asia, where livestream commerce is emerging.

Understanding Douyin gives global brands insights on where TikTok and content-driven e-commerce are headed in the near future as it continues to mature.

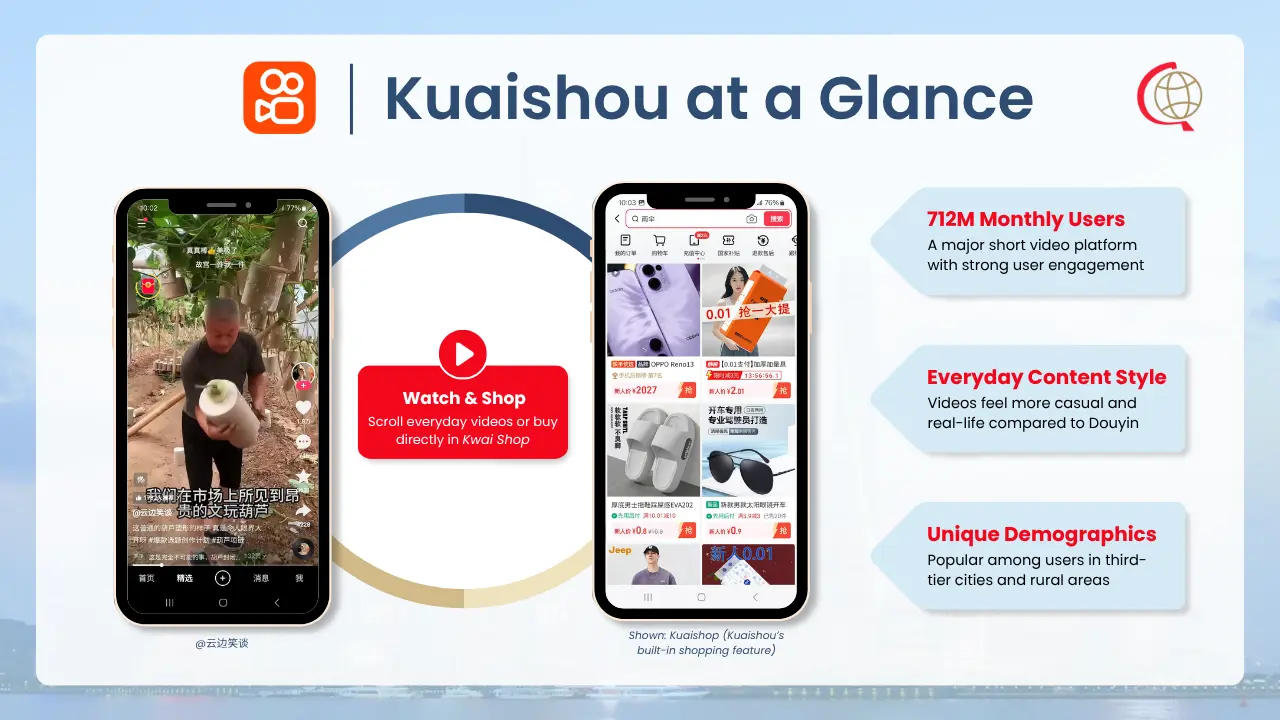

6. Kuaishou: Popular Among Lower-Tier Cities

Known for: Community-driven content in lower-tier cities and rural areas

At first glance, Kuaishou feels similar to Douyin. Both are short video platforms where livestreaming plays a central role in their e-commerce functionalities. As a short video platform, it boasts 712 million monthly active users (about 29% less than Douyin).

While Douyin appeals to young, urban users, Kuaishou has a stronger presence in lower-tier areas, with 60% of users from third-tier and fourth-tier cities. Moreover, Kuaishou’s users have a broader age distribution, attracting many middle-aged and elderly users.

You’ll notice that both app interfaces are nearly identical. You’ll find scrollable feeds, short dramas, and built-in stores on both. Nevertheless, their audience demographics differ sharply.

In terms of content culture, Douyin tends to showcase polished content centered on fashion, entertainment, and education. In contrast, Kuaishou is known for its less curated, everyday videos that reflect real life. Many refer to this as 老铁文化 (lǎo tiě wén huà) or “bro culture,” a term for the close-knit, loyal bond between creators and their followers.

Despite these differences, Kuaishou also offers “Kuaishop,” an in-app e-commerce platform similar to Douyin’s, with sellers offering daily goods, gadgets, and promotional snack bundles.

7. Xiaohongshu (RED): Aesthetic-Driven Discovery with High Trust

Known for: Lifestyle discovery and trusted peer advice

Xiaohongshu (RedNote) started as an overseas shopping guide and has grown into a lifestyle-focused platform. It’s now a trusted search engine for lifestyle decisions—combining the best of Instagram and Pinterest’s aesthetically visual content for product discovery.

The platform has 242 million monthly active users (up 13.2% YoY), with a core demographic of young, urban consumers:

- 43% are aged 18–24

- 72% are female (nearly 30% male)

- 66% live in first-tier and new first-tier cities

With such a user base, Xiaohongshu has become known as a hotspot for lifestyle, fashion, and skincare inspiration. It’s commonly used to discover trending cafés, skincare routines, travel tips, and more. Beyond physical goods, users also sell digital products like guides and courses directly on the platform.

Most of the content found here is for discovering and becoming inspired through UGC (user-generated content). More recently, the platform has featured more globally diverse content from foreign influencers and expats living in China. This shift attracted new audiences and encouraged more global brands to explore the platform as a way to reach Chinese consumers.

Since 2019, Xiaohongshu has enabled brands to open in-app stores. This was an intuitive step given the platform’s role in influencing purchase decisions. To increase visibility, brands often collaborate with influencers to create UGC that drives both brand awareness and credibility.

8. Bilibili: Gen Z Platform with Niche E-Commerce Power

Known for: video content with integrated creator commerce

Bilibili is often thought of as a video platform much like YouTube, where ecommerce functionality might not be expected. Yet, while it remains primarily content-first, it has developed unique commerce features that cater to its active user base.

Originally focused on anime, comics, and gaming (ACG) culture, Bilibili has expanded to become a broad entertainment hub attracting highly engaged Gen Z and young Millennials. Looking at Bilibili’s Q1 2025 user statistics, the platform boasts 107 million daily active users and over 368 million monthly active users. Over 65% of its audience belongs to Gen Z and younger generations.

While not primarily an e-commerce platform, Bilibili offers creators multiple ways to monetize. Creators, known as UP masters, can open personal stores to sell merchandise such as apparel and collectibles. They also offer blind boxes where fans can win prizes ranging from expensive figurines to refrigerator magnets.

Bilibili’s e-commerce is driven mostly by small and mid-sized creators rather than celebrity influencers, reflecting how its community prefers authentic, niche-driven shopping experiences embedded within shared interests.

It’s especially popular for electronics and ACG merchandise, making it a unique blend of culture and commerce.

Conclusion: One Market, Many Models

While China is one market, there are many modes of selling, discovering, and engaging. Each platform plays a distinct role, from product search and brand building to online sales. Together, they shape a highly interconnected digital shopping experience.

In this overview, these popular companies and their key statistics are just one piece of a much larger puzzle. To deepen your understanding, explore our full breakdown of China’s e-commerce landscape for insights and strategies for navigating this unique market.

For deeper insights that can spark your business strategy, explore our full breakdown of China’s e-commerce industry. It’s packed with practical takeaways to inform your business strategy and help you navigate this fast-evolving market.

0 Comments