Open any Chinese shopping app, and you’ll notice something different: influencers selling everything from skincare to real estate through livestreams.

Behind this shift are MCNs (Multi-Channel Networks)—the operational backbone supporting China’s top influencers and livestreamers. Through connecting brands with influential online figures, these agencies coordinate marketing campaigns that boost awareness and sales.

If you’re familiar with Western influencer marketing, China’s MCN model will feel surprisingly different. While their Western counterparts focus on ad revenue, the role of MCNs in China extends far beyond what you might expect from influencer marketing.

What Is an MCN? Breaking Down the Model

An MCN (Multi-Channel Network), known in Chinese as 内容中介机构 (nèi róng zhōng jiè jī gòu), is essentially a hybrid between a talent and content creation agency. Think of them as the matchmakers that connect online figures with brands to sell products or build brand awareness.

Here’s where Chinese MCNs differ significantly from their Western counterparts. Western MCNs, particularly those working with YouTube creators, primarily focus on maximizing ad revenue and securing brand partnerships. Their success is measured in views, engagement rates, and sponsorship deals.

Chinese MCNs, however, mostly work with both Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs). They handle everything from training, guiding content development, and shaping the influencer’s online presence—all to help the collaborating brand reach more users.

Put simply, a Chinese MCN manages social media personalities for diverse content production (e.g., livestreams, short dramas, and ads).

Market Snapshot: How Big Is China’s MCN Ecosystem?

According to the 2025–2030 China MCN Industry Market Analysis and Forecast and the 2024–2025 China Livestream & Short Video MCN Agency Development Report, China’s MCN ecosystem is projected to exceed 60,000 agencies with a market size of roughly $9.75 billion by 2025.

These projections highlight the significant growth and diversification of China’s MCN industry, driven by expanding agency numbers and an increasing market value.

The MCN Ecosystem: Platforms & Use Cases

Chinese MCNs operate across several distinct business models, each serving different market needs:

- IP incubators: develop and monetize intellectual properties (e.g., characters, shows, or brand concepts)

- Talent matrix platforms: manage a large network of influencers across genres

- Marketing-driven agencies: connect brands with KOLs for strategic advertising campaigns

- Vertical content brands: specialize in specific niches (e.g., beauty or fashion) to build deeper expertise

To reach a larger audience, these MCNs distribute content across the major Chinese platforms:

- Douyin (China’s version of TikTok) dominates short-form video in both urban and rural areas

- Kuaishou focuses on short-form videos and livestreams for smaller-city audiences

- Xiaohongshu serves as China’s lifestyle discovery platform

- Taobao integrates shopping directly into livestreams

- Bilibili caters to younger, more engaged communities

- Weibo drives trends through text posts and influencer content

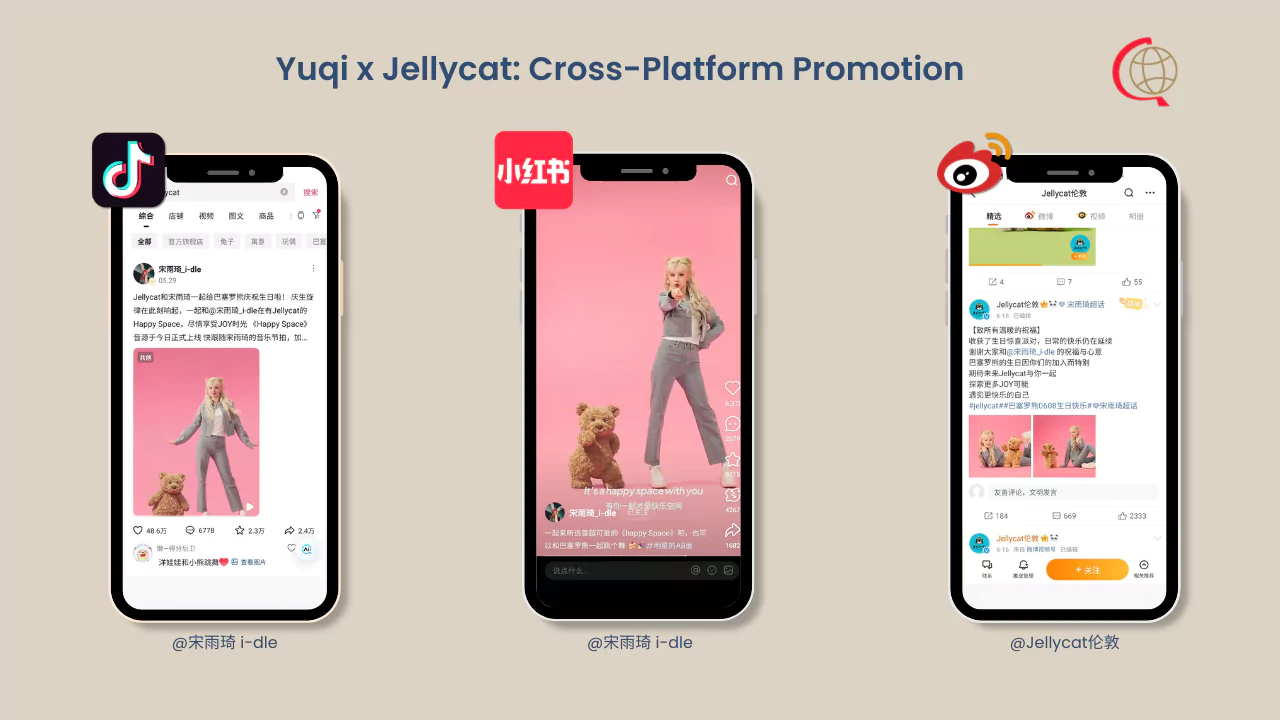

Use Case 1: Jellycat’s Celebrity Partnership

British toy brand Jellycat collaborated with celebrity influencer Song Yuqi to connect with more customers in China. Such high-profile partnerships would typically involve MCN coordination. They would handle the talent negotiations, content strategy across platforms, and campaign amplification to ensure consistent messaging and broad reach.

Use Case 2: KOL Partnerships for Livestream Sales

In China’s livestream e-commerce model, influencers host live shopping sessions where they interact with viewers who can purchase instantly through the stream. Brands typically work with MCNs to identify livestream hosts who match their target demographics and can authentically present their products during these real-time sales events.

For example, during the 2024 “Double 11” shopping festival, Gao Yuyu (@高芋芋) generated over 100 million RMB in sales for Kans skincare—setting a three-day sales record for the brand in the process.

Interestingly, the scale of livestream e-commerce in China is so significant that Hangzhou features X27 Park, a 24/7 shopping complex where you can also watch KOLs broadcasting live as they promote products in real time.

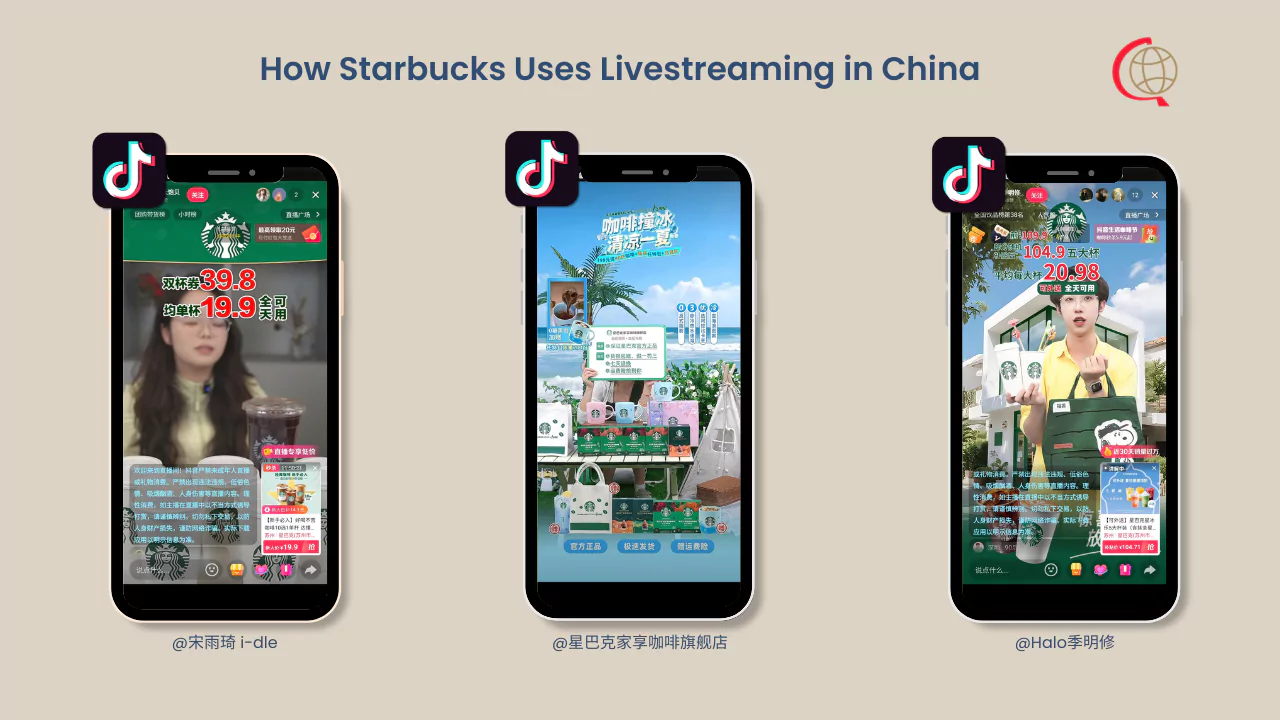

Use Case 3: Starbucks Using Douyin Livestreams

Beyond large shopping festivals, many brands leverage livestreaming for daily engagement. Among them, Starbucks China is a great example.

Starbucks regularly collaborates with livestream hosts on Douyin to promote limited-time drinks, seasonal campaigns, and special offers. These KOLs focus on clearly and repeatedly highlighting key promotion details (e.g., what the deal includes) to encourage fast conversions. Such a strategy helps the brand stay in front of consumers and drive daily sales.

Why MCNs Succeed in China: Culture, Speed & Commerce

Generally, people like to buy from those they trust. In China, KOLs and KOCs fill that role, and MCNs amplify this trust by running promotional events where consumers can interact with these influencers in real time.

The structural foundation supporting MCNs is equally important. As can be seen from the Starbucks example, the country hosts mobile-first platforms (e.g., Douyin, Kuaishou, and Taobao) that allow users to watch a product demonstration and complete a purchase without leaving the app.

Additionally, the country is known for fast logistics networks that ensure next-day or same-day delivery in major cities. This speed complements the instant nature of livestream shopping, making influencer-driven sales even more effective.

Rather than superior technology, MCNs succeed in China because livestreams have become a normal way to shop online—and this is leveraged by bridging brands to trusted online voices.

The Global Implication: What Businesses Can Learn from MCNs

International brands can learn from MCNs’ deep understanding of China’s content platforms and the key players who operate within them. They thrive by using this understanding to connect the right creators with the right opportunities, becoming essential facilitators in the process.

The Chinese MCN model highlights the importance of understanding the country’s broader digital marketplace. To really grasp this, it helps to look at the whole ecosystem behind MCNs—and what businesses can learn from China’s e-commerce industry.

0 Comments