Newsletters 20240708

China’s Manufacturing PMI for May was 49.5, While the Non-manufacturing Sector Continued to Expand

According to the data released by the National Bureau of Statistics on June 30th, the Manufacturing Purchasing Managers’ Index (PMI) was 49.5%, the same level as the previous month.

PMI during the last 12 months

When viewed by company size, the PMI for large enterprises was 50.1%, a decrease of 0.6 percentage points from the previous month; the PMI for small and medium-sized enterprises stood at 49.8% and 47.4%, respectively, increasing by 0.4 and 0.7 percentage points from last month.

Looking at the sub-indices comprising the manufacturing PMI, the production index (50.6%) remained above the critical threshold, decreasing by 0.2 percentage points; the supplier delivery time index (49.5%) decreased by 0.6 percentage points. Meanwhile, the employment index (48.1%), On the same level as last month, raw material inventory index (47.6%), and new orders index (49.5%), dropping by 0.2 percentage points and 0.1 percentage points, were below the critical threshold.

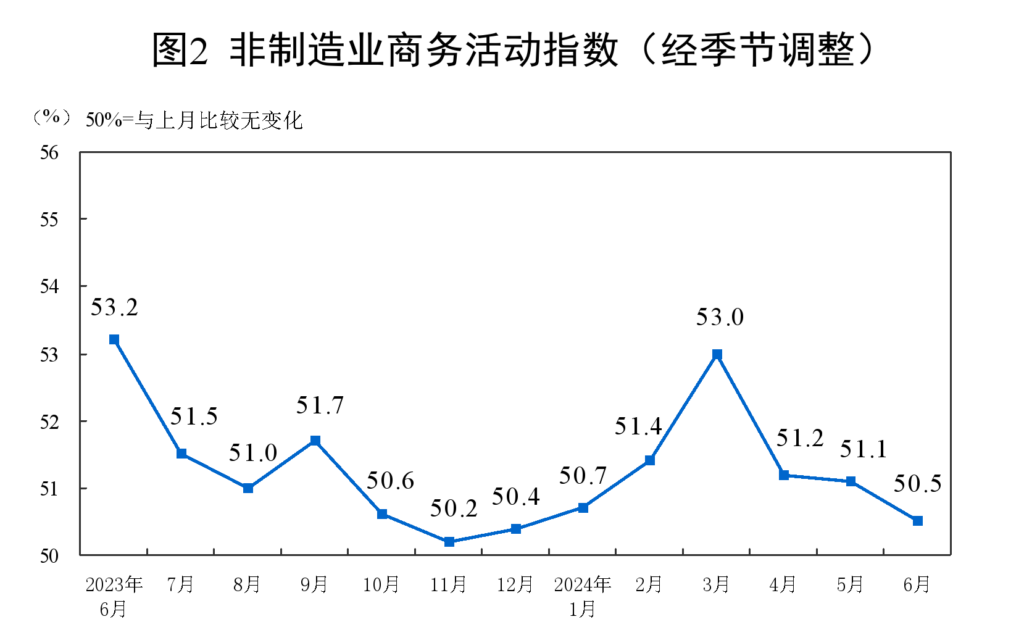

In June, the non-manufacturing business activity index was 50.5%, decreased by 0.6 percentage, remaining above the critical threshold, indicating that there is a continued expansion in the non-manufacturing sector.

Non-manufacturing business activity index during the last 12 months

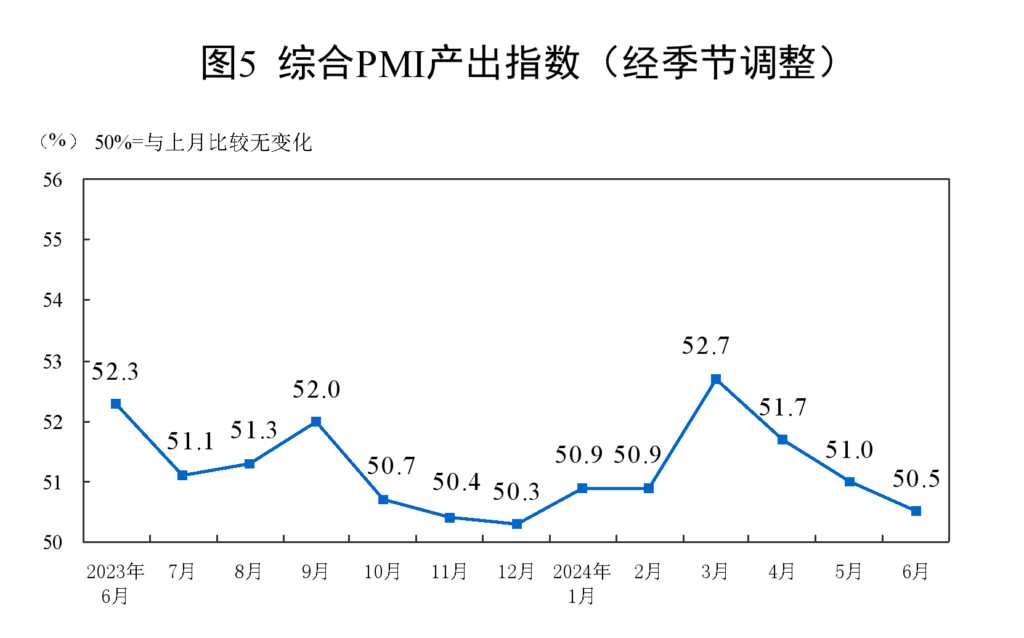

In June, the Composite PMI output index was 50.5%, a decrease of 0.5 percentage points compared with the previous month, but still above the critical threshold, indicating that business production and operations in China continue to recover and develop.

the Composite PMI output index during the last 12 months

Data Source: https://www.stats.gov.cn/sj/zxfb/202406/t20240630_1955251.html

China’s latest mega 24 km cross-sea link between the cities of Shenzhen and Zhongshan opens to traffic

The Shenzhen-Zhongshan Corridor opened for trial operation on June 30th at 3 pm.

The Shenzhen-Zhongshan Corridor is a cross-sea passage connecting Shenzhen and Zhongshan, but also a world-class engineering miracle integrating “bridges, islands, tunnels, and underwater inter-connection”.

What does the opening of the Shenzhen-Central Corridor mean for the Guangdong-Hong Kong-Macao Greater Bay Area?

This marvelous infrastructure will help promote economic and cultural exchanges and cooperation between the east and west sides. After the Shenzhen-Zhongshan Corridor opens, it will take less than half an hour to go from Shenzhen to Zhongshan. It will also take less than an hour to go from Zhuhai and Jiangmen to Shenzhen, and 15 minutes to go from Nansha of Guangzhou to Zhongshan. According to the traffic department data, it is predicted to be more than 80,000 vehicles daily that will use the Shenzhen-Zhongshan Corridor.

The Greater Bay Area (GBA) needs a three-dimensional transport system that connects its city clusters, especially the cross-sea bridges, which are important for integrated development. The Guangdong-Hong Kong-Macao Greater Bay Area has three bridges: the Humen Bridge in the north, the Hong Kong-Zhuhai-Macao Bridge in the south, and the Shenzhen-Zhongshan Corridor connecting Shenzhen with western Zhuhai. At the same time, many major transport projects are being built, including the Zhonghai Expressway, Shenzhen River Railway, South China Intercity, etc.

The east-west of the Bay Area exchanges are now more open. Transport links between Shenzhen and Hong Kong are helping to bring high-end talent, technology, and industry to cities like Zhongshan and Zhuhai. It will greatly contribute to the development of the digital economy, artificial intelligence, and smart manufacturing. Universities in Shenzhen and Hong Kong are working with the west bank of the Pearl River to build a world-class city cluster. With flows of vehicles, people, and logistics means, more infrastructure and public services can be built, which will all help build a circular and smooth Greater Bay Area.

Data Source: https://www.gov.cn/yaowen/tupian/202406/content_6960288.htm#1

Huawei AITO’s Trademarks Transferred to Seres for CNY 2.5 Billion

On July 2nd, Seres released a public announcement regarding the acquisition of Huawei Technologies Ltd. and its affiliates. The acquisition will include 919 AITO and other series of text and graphic trademarks that have been registered or are in the process of application, as well as 44 related design patents. The purchase price will total CNY 2.5 billion.

In response, Huawei stated that it would transfer the AITO and other series of trademarks to Seres while continuing to support Seres in the development and sale of AITO.

There are different voices for this transferring.

Some believe that the main reason for the trademark change is that AITO wants to dilute Huawei’s presence overseas. As is well known, Huawei’s products are facing significant challenges in Europe and the US due to US sanctions. According to media reports, the Aito overseas model’s badge has been changed from AITO to SERES. The AITO M5, M7, and M9 correspond to the overseas naming of Seres 5/7/9. Following the transfer of the trademark, the product and brand are unified, which is beneficial for overseas sales.

Some insist that trademark change is more about the strategic position of Huawei itself. From internal resolutions to public statements, Huawei has consistently maintained that it does not engage in the manufacturing of automobiles. In reality, before Seres acquired the AITO [9] trademark, Huawei already transferred the Luxeed and Stelato trademarks to the corresponding Smart Choice partners, Chery and BAIC, respectively, further reinforcing Huawei’s commitment to its strategy. Some take it grantly for evidence that Huawei does not engage in automotive manufacturing.

Data Source: http://www.sse.com.cn/disclosure/listedinfo/announcement/c/new/2024-07-03/601127_20240703_HHRO.pdf

Starbucks China Has Announced Fee Adjustments for Its Official Takeaway Delivery Channel

Recently, Starbucks experienced a decline in revenue in China in the first quarter of this year.

It is the second year that the industry engaged in a price war. In May 2023, Cotti Coffee initiated the “daily 9.9” promotional campaign, marking the onset of a price war in the coffee industry. In less than a month, Luckin Coffee announced the launch of shop promotions, the weekly launch of CNY 9.9 coffee singles, and in June, the opening of the weekly CNY 9.9 regular promotional activities, which will continue for at least two years.

Starbucks is reluctant to engage in the price war, with Starbucks CEO Laxman Narasimhan emphasizing that Starbucks is always a premium brand. A case in point is that Starbucks is launching a greater number of new products in China. In the second fiscal quarter, Starbucks China launched 27 new products, representing a significant increase from the previous quarter and a threefold increase from the same period last year. However, this works little to alter the downward trajectory of Starbucks’ revenue in China.

Data Source: https://apps.apple.com/cn/app/星巴克中国

It’s Crazy! There Were Long Queues at Disney China at 3 am.

On July 3rd, Shanghai Disneyland experienced unusually long queues, with many young visitors waiting at the park’s entrance from 3 am.

At 10 am, a social media user posted a photo stating that there were already like “millions of people” at Disney, and the venue was overcrowded.

Why are there so many people at Disney on July 3rd?

According to the Shanghai Disney Resort’s WeChat public account, the new Summer Duffy and Friends plush toys will go on sale on July 3rd, with the official flagship store opening at the same time at 10 am.

The item is currently available on second-hand platforms the price of which has risen from the original CNY 259 to the current CNY 359.

It is worth noting that the previous Shanghai Disneyland merchandise has been the subject of speculation regarding its potential trading value, leading to a heated debate on numerous occasions.

In September last year, Shanghai Disney updated its “Mickey and Friends Series” merchandise. Among the new products launched was a range of Goofy merchandise featuring the character of a purple flying dragon. The range included keyrings, plush toys, and other items. The price of this Goofy was speculated to be CNY 8,000.

Early in August 2021, the Stella Lou Mid-Autumn Festival limited doll sold out in just three days. The original price of CNY 359 was speculated to be a high price of CNY 2,599. In December, the original price of the CNY 219 Lina Bell plush doll was increased to CNY 2,488. In response, Shanghai Disney stated that they did not engage in “starvation marketing” and that the shortage of supply was due to short-term high demand and other factors influenced by production bottlenecks. Shanghai Disney also apologized for the first replenishment of a limited number of temporary items failing to meet the majority of tourists and fans’ purchase needs and stated that they will further optimize the on-sale program.

0 Comments