1. Audi and SAIC formulate strategic partnership to fast-track Electrification amid rapid market shift in China

On 20th April, in a significant move towards sustainable mobility, Audi confirmed a strategic partnership with China’s state-owned SAIC Motor Corp. Both entities are committed to expedite the electrification of their automotive portfolio, aligning with the rapid transition towards electric vehicles (EVs) within the Chinese market.

While Audi has not disclosed further specifics regarding the partnership, there are unconfirmed reports indicating Audi’s interest in utilizing a proprietary platform of IM Motors, SAIC’s premium EV brand. This collaboration is seen as a strategic step to bolster their competitiveness in the Chinese market.

Audi, along with other brands under the Volkswagen Group, acknowledges the necessity to accelerate their transition to EVs in China. The challenge lies in overcoming the constraints of lengthy development cycles that have traditionally inhibited new vehicle launches.

Concurring with Audi’s stance, SAIC has also affirmed that the Chinese auto market is experiencing a paradigm shift, the likes of which are unprecedented. Both companies aim to deepen their strategic cooperation in response to these market dynamics. Interestingly, this alliance is forged at a critical juncture, as both Volkswagen and SAIC grapple with a declining market share in China.

The collaboration also symbolizes a significant turn of the tables, as China’s automakers begin to emerge as licensors of EV technologies rather than the conventional role of licensees. This showcases the growing prominence and technological prowess of China in the global EV space.

2. H1 2023 Vehicle Sales Soar with Diverse Growth Trajectories Among OEMs

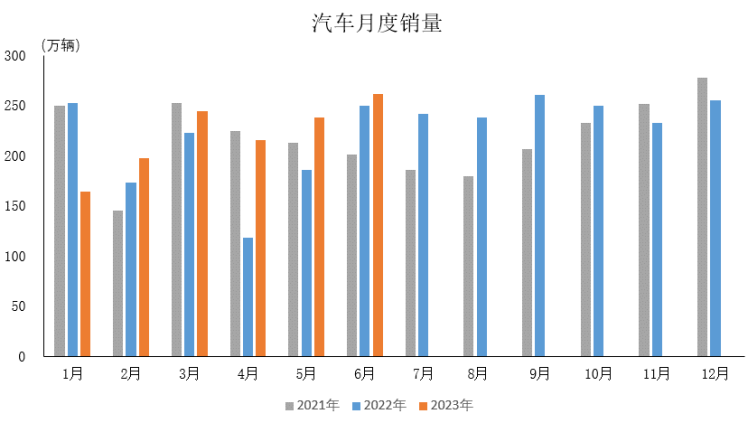

The latest report released by the China Association of Automobile Manufacturers (CAAM) underscores a substantial upswing in vehicle production and sales for the first half of 2023, albeit with distinct growth patterns observed among OEMs.

In June alone, vehicle production and sales scaled to 2.561 million and 2.622 million units respectively, marking a monthly growth of 9.8% and 10.1%. On a year-on-year basis, these figures translate to an increase of 2.5% in production and a more impressive 4.8% surge in sales.

Accumulated data from January to June 2023 further substantiates this positive trend. Vehicle production and sales during this period reached 13.248 million and 13.239 million units respectively, indicative of a robust year-on-year growth of 9.3% and 9.8%.

However, a granular examination of each OEM’s performance paints a more complex picture. SAIC, despite retaining its position as the leading OEM, appears to be gradually ceding market share to competitors including BYD, BAIC, Geely, and Chery. This emerging trend hints at a dynamic and competitive landscape within China’s auto industry and is a space to watch as we move further into 2023, as some more OEMs might exit the market.

3. Evergrande Group reports historic financial losses in the largest corporate debt restructuring in Chinese history

Evergrande Group, recognized as the world’s most indebted property developer, recently unveiled long-awaited financial results, shedding light on a substantial debt restructuring operation—one of the most significant in China’s corporate history.

The company reported losses attributable to shareholders of 476 billion yuan ($66 billion) and 106 billion yuan ($15 billion) for 2021 and 2022, respectively, according to a stock exchange filing on 17th July. Combined net losses for the two years amounted to 582 billion yuan ($81 billion).

In terms of liabilities, by the end of 2022, Evergrande’s total liabilities stood at a massive 2.437 trillion yuan. However, what’s most striking is Evergrande’s current negative net asset position. As per the 2022 financial reports, Evergrande’s total assets, meanwhile, were valued at only 1.838 trillion yuan against total liabilities of about 2.437 trillion yuan, resulting in a negative net asset balance of nearly 599 billion yuan, indicating a severe insolvency situation.

Prism Hong Kong and Shanghai Limited, the auditing firm reviewing Evergrande’s 2022 financial report, stated it “could not express an opinion,” citing numerous uncertainties concerning Evergrande’s ongoing operations and potential misstatements in opening balances and comparative figures.

This dire situation for Evergrande is emblematic of the end of an era, marking a definitive close to China’s once-booming real estate market. Regardless of Evergrande’s future, its current state signals a turning point in the industry’s history.

4. Visa and Mastercard can now be used on China’s biggest payment apps

Starting from 21st July, a landmark update enables visitors in China to connect their Visa and Mastercard accounts with the country’s top mobile payment applications, Alipay and WeChat Pay. This integration paves the way for foreign cardholders to conveniently book taxis, use subway services, and execute payments at millions of locations across China, a country rapidly moving towards a cashless economy.

This development represents a renewed commitment by Alipay and WeChat Pay to embrace foreign credit cards, following limited access offered in late 2019. The fintech giants previously acknowledged that their actions were in sync with guidance from Chinese regulators, reflecting Beijing’s intention to attract foreign investment and international tourists to revitalize its sluggish economy.

Alipay, the largest payment app in China, run by Ant Group, made an announcement on Friday stating that global users can now link cards issued by Visa, Mastercard, as well as Diners Club and Discover to their digital wallets, effective immediately.

To facilitate a seamless travel experience in China, our “Glopen Travel” program offers assistance in setting up these digital payment tools. This enhancement is a significant step towards fostering a more inclusive, connected, and user-friendly digital payments landscape for visitors to China.

5. Henry Kissinger warmly welcomed in the hotel he first visited in 1971

In recent months Secretary of State Antony Blinken, Treasury Secretary Janet Yellen, and special presidential envoy for climate John Kerry have all visited Beijing, but results have been mixed.

China’s response to these visits were less than enthusiastic. Of the three Biden policy principals who recently sojourned to Beijing, Chinese Premier Xi Jinping only met with Blinken.

However, China rolled out the red carpet for former National Security Adviser and Secretary of State Henry Kissinger, while also welcoming him with a lavish meal at the hotel where he first met President Mao in 1971. He not only met with President Xi, but also with China’s top diplomat, Wang Yi, and defense minister Li Shangfu, the person Austin was not able to see. The praise coming from China’s collective leadership was fulsome. Wang said that Kissinger, “has made historic contributions to breaking the ice in China-U.S. relations, and played an irreplaceable role in enhancing understanding between the two countries.” Xi was even warmer with his words: “The Chinese people never forget their old friends, and Sino-U.S. relations will always be linked with the name of Henry Kissinger.”

0 Comments