1.SWIFT Report: CNY’s Share of Global Payments Has Fluctuated

On May 23, SWIFT released its latest report, indicating that the share of the Chinese yuan (CNY) in global payments decreased to 4.52% in April, down 0.17 percentage points from 4.69% in March. Despite the drop, the CNY remains the fourth most active currency in global payments.The data shows that in January, the CNY’s share in SWIFT global payments was 4.51%, a significant increase of 0.37 percentage points from 4.14% in December of the previous year. However, due to factors such as the Chinese New Year holiday, the share fell by 0.51 percentage points to 4% in February. In March, as China’s foreign trade rebounded and international capital flocked to invest in Chinese financial assets, the CNY’s share in global payments reached a new high of 4.69% for the year, up 0.69 percentage points year-over-year. However, a month later, this figure fell back to 4.52%.

As the CNY’s share in global payments surpasses the 4% threshold, the fluctuations in its global payment share have become the “new normal” this year. Compared to the average monthly fluctuation of about 0.2 percentage points in the past, the volatility has increased, driven by four main factors:

- Increased fluctuation in the euro’s share of global payments, which has impacted CNY’s share to some extent.

- The heightened impact of holiday factors on the CNY’s share in global payments.

- The growing significance of global trade payment cycles, such as the seasonal peak in trade contracts between companies abroad and Chinese enterprises in March, boosting CNY cross-border trade settlement volumes.

- Since March, the surge in global capital investing in Chinese stocks and bonds has expanded the use of CNY in cross-border securities investments, contributing to the increased volatility in the CNY’s global payment share.

2.A Surge of International Visitors to China Reflects Inbound Tourism Growth in 2024

According to the latest data from the Beijing Municipal Bureau of Culture and Tourism released on May 19, Beijing has welcomed 469,400 inbound overnight visitors in 2024, reflecting a staggering 314.9% year-over-year increase. This surge underscores the robust recovery of international tourism to the Chinese capital.

Further highlighting the tourism boom, reports on May 19 indicated that group tour bookings from South Korea to China in May skyrocketed by 608% year-over-year. This surge in demand demonstrates renewed interest and confidence among South Korean travelers in visiting China. Additionally, data from the Russian travel service platform OneTwoTrip revealed that searches for hotels in Guangzhou, Beijing, and Shanghai in April tripled compared to the previous month. This significant increase in search activity underscores growing interest among Russian tourists in China’s major cities.

Moreover, the Hong Kong-Zhuhai-Macao Bridge checkpoint reported a remarkable milestone. As of 9:40 AM on May 21, the number of passengers crossing the Zhuhai highway port has surpassed 10 million so far this year, representing a year-over-year growth of over 127.7%. This milestone was achieved four months earlier than in 2023, setting a new record for the fastest time to reach 10 million passengers since the port’s opening.

These impressive figures collectively highlight a strong resurgence in international tourism across China, driven by increased travel demand from key markets. As China continues to rebound from the pandemic, these trends point to a positive outlook for the country’s tourism sector.

3.The Online Car-hailing Industry in China Is Currently Experiencing Saturation in Many Locations

Since May 21, several Chinese cities have issued warnings about the online car-hailing industry. Data from China’s transportation authorities reveal that some platforms are non-operational, while others have fewer than 50 vehicles and average less than 1,000 daily orders. The business situation for online car-hailing drivers is equally challenging. In many areas, a single car receives an average of fewer than 20 orders per day, earning approximately CNY 20 per order, with a daily income of just over CNY 200 per vehicle. The warnings indicate that the supply of online car-hailing services in many cities exceeds the actual demand.

These warnings highlight that supply far exceeds demand in numerous cities. Amid the rapid expansion of the online car-hailing industry, it is no longer advisable for businesses or individuals to enter this market. Those who are eager to make money by driving a car to support their families may find it challenging to achieve their desired outcome, and may also fall into some kind of trap by engaging with a bad business “harvest.”

The saturation of the online car-hailing market underscores broader economic challenges, as more unemployed individuals turn to this industry due to its low entry barriers and limited alternatives. The stagnation and decline in income, coupled with an increasing number of drivers, has resulted in a significant supply-demand imbalance.

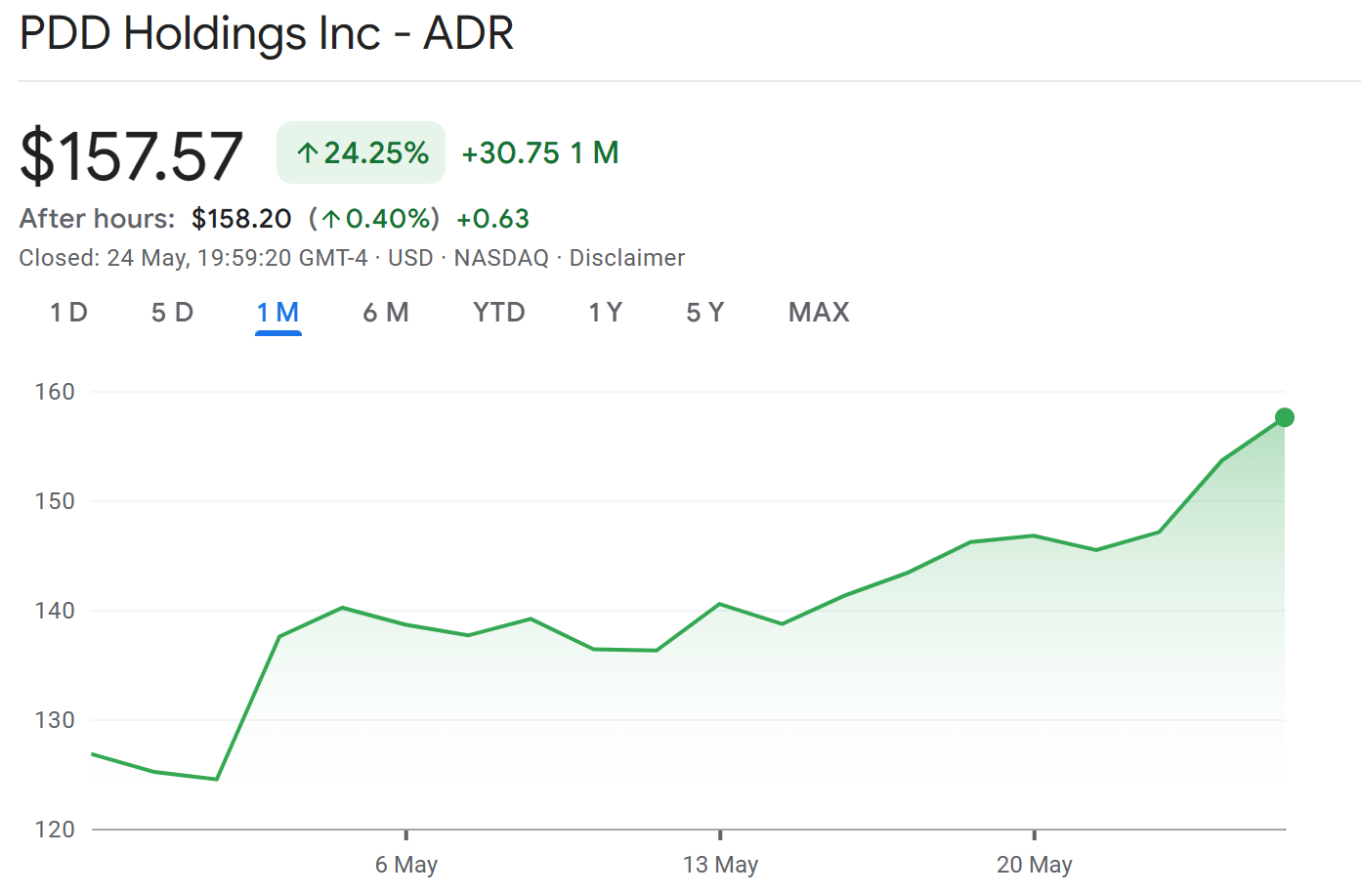

4.Pinduoduo Generates Approximately CNY 90 Billion in Q1 Revenue

On May 22, the e-commerce giant Pinduoduo released its Q1 2024 financial results, showcasing remarkable growth. The company reported revenue of CNY 86.8 billion, surpassing market estimates of CNY 76.86 billion, and representing a 131% increase year-over-year. Adjusted net profit reached CNY 30.60 billion, significantly higher than market expectations of CNY 15.53 billion, marking a 202% surge year-over-year. Earnings per ADS were CNY 20.72, exceeding the market estimate of CNY 10.54. This impressive performance boosted Pinduoduo’s market capitalization to $212.9 billion, overtaking Alibaba’s $205.9 billion. In less than 10 years, Pinduoduo has emerged as a formidable competitor to Alibaba, thrilling investors and prompting competitors to take notice.

This growth comes amid data from China’s National Bureau of Statistics (NBS), indicating steady market sales with online retail sales of physical goods up 11.6% year-on-year. Pinduoduo’s outstanding performance highlights its resilience and strength as an e-commerce giant, achieving an adjusted net profit of over CNY 30 billion in just one quarter.

Observers note that Pinduoduo has distinguished itself as China’s leading e-commerce platform with a workforce of just 13,000 employees, compared to the hundreds of thousands employed by Alibaba and JD.com.

The era of AI-powered e-commerce is still in its early stages, presenting opportunities and challenges alike. Notably, the last time Pinduoduo’s market value surpassed Alibaba’s, Jack Ma made a rare appearance, expressing his belief that Alibaba would undergo a transformation. This situation could be beneficial for Alibaba, enabling it to become more agile by shedding its current burdens. Meanwhile, the pressure has increased on Pinduoduo, as its strategies come under closer scrutiny from numerous competitors.

5.Due to His Inability to Repay Loans, Zhang Kangyang Has Relinquished His Ownership of Inter Milan

According to several Italian media reports, Inter Milan’s current chairman, Zhang Kangyang, has been compelled to leave the team due to the inability to repay loans and interest. To address financial challenges posed by the pandemic, Zhang and Suning Group secured a three-year loan of €275 million from the fund company Oaktree Capital in May 2021, with an annual interest rate of 12%. The loan was secured by the club’s shareholding. If the loan was not repaid by May 21, 2024, Oaktree Capital would take control of Inter Milan’s shares and become the owner of the club.

Zhang made continuous efforts to retain control of Inter Milan, reaching out to various organizations and investors. However, despite these efforts, no consensus was reached. Zhang issued a statement attributing the failure to external interference, accusing Oaktree Capital of unilateral legal threats and malicious actions that ultimately led to his loss of ownership of Inter Milan. Furthermore, Zhang engaged in multiple rounds of negotiations with Oaktree Capital, proposing to extend the loan by increasing the interest rate, but all proposals were rejected.

With the final deadline for loan repayment having passed, Zhang and Oaktree Capital have agreed to proceed with the procedural steps. Zhang’s failure to repay Oaktree Capital highlights the debt level of Suning Group and a decline in trust from financial institutions.

0 Comments