1.In April 2024, the national CPI for Residents Increased by 0.3% Year-on-Year

In April 2024, national consumer prices rose 0.3% year-on-year. Among which, urban areas and rural areas rose by 0.3% and 0.4%; food prices fell by 2.7% and non-food prices rose by 0.9%; prices of consumer goods remained stable and prices of services rose by 0.8%. From January to April, the nation’s consumer prices increased by 0.1% on average compared to the same period of the previous year.

On a month-to-month basis, national consumer prices rose by 0.1% in April. Among them, urban increased by 1.0% while rural areas remained stable; food prices fell by 1.0% while non-food prices rose by 0.3%; consumer prices decreased by 0.1% while service prices increased by 0.9% and 1.1% respectively.

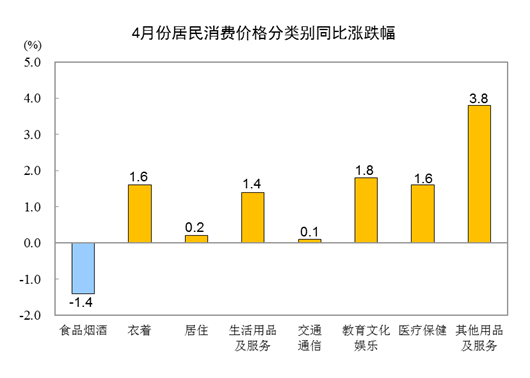

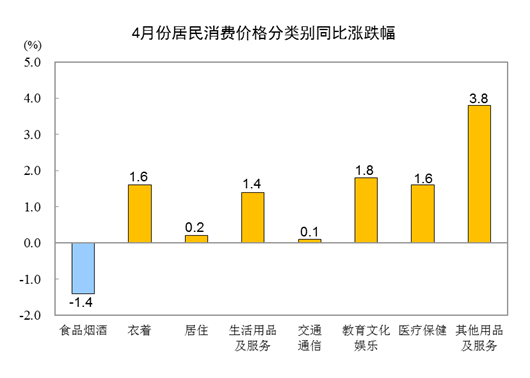

In April, The price of food and tobacco dropped by 1.4% year-on-year, contributing to a decrease of approximately 0.39 percentage points in the CPI. Prices in the other seven major categories all rose on a year-on-year basis. Specifically, prices for other goods and services, and education, culture, and entertainment increased by 3.8% and 1.8%, respectively. Clothing and healthcare both saw a rise of 1.6%. Prices for household goods and services, housing, and transportation and communication rose by 1.4%, 0.2%, and 0.1%, respectively.

The other seven major categories of prices witnessed both rise and fall. The prices of clothing, other goods and services rose 0.6% while residential and health care prices rose 0.1%; living goods and services prices were flat; education, culture and entertainment, transportation and communication prices fell 2.1% and 1.4% respectively.

In April, as consumer demand continued to recover, the national CPI shifted from a decrease to an increase on a month-on-month basis, and the year-on-year growth rate expanded.

Data Source: https://www.stats.gov.cn/sj/zxfb/202405/t20240511_1955441.html

2.China Extends Short-term Visa Exemption for 12 Countries Until the End of 2025

May 7, 2024, China will extend its visa-exemption policy for short-term visitors from 12 countries through December 31, 2025, announced Lin Jian, spokesperson for the Chinese Foreign Ministry, on Tuesday.

This extension applies to citizens from France, Germany, Italy, the Netherlands, Spain, Malaysia, Switzerland, Ireland, Hungary, Austria, Belgium, and Luxembourg. The decision underscores China’s commitment to enhancing bilateral relations and cultural exchanges with these nations.

The announcement follows remarks by President Xi Jinping during his recent visit to France, where he expressed China’s enthusiasm for welcoming more visitors from these countries and reaffirmed the extension of the visa-free policy. This initiative is part of China’s broader strategy to strengthen international ties and cultural understanding.

Data Source: https://english.www.gov.cn/news/202405/07/content_WS663a0d9cc6d0868f4e8e6d10.html

3.The Cities of Xi’an and Hangzhou Have Lifted Housing Purchase Restrictions

May 9, 2024, Xi’an and Hangzhou, two of the new first-tier cities in China, have announced the complete abolition of housing purchase restrictions, effective immediately. The new policy allows anyone, regardless of previous home ownership qualifications, to purchase residential properties in these cities. Additionally, in Hangzhou, individuals with non-local household registrations can now apply for legal property rights and potential settlement.

This policy shift comes in response to a notable decline in housing demand and a surplus in the housing inventory. The lifting of restrictions is intended as a measure to reduce this excess stock. Economic factors, including a decrease in buyer confidence and a mismatch between housing prices and average purchasing power, have fueled this downturn. In the current market, positive news on investment goods is of no benefit when the market is in a downturn. The persistent decline in the property market is not solely due to purchase restrictions but also stems from broader issues such as consumer confidence, income levels, residents’ marriage rate and birth rate, and economic expectations.

Currently, housing purchase restrictions remain in place only in four first-tier cities—Beijing, Shanghai, Guangzhou, and Shenzhen—as well as in Tianjin and Hainan Province.

How will these four first-tier cities react to the market under this context?

4.China’s High-speed Rail fares are Increasing in Price

After Labor Day holiday, the official China Railway 12306 website has issued four key announcements regarding fare adjustments on several sections of China’s high-speed rail network. These adjustments include the Wuhan-Guangzhou section of the Beijing-Guangzhou High-Speed Railway, the Shanghai-Hangzhou and Hangzhou-Changzhou sections of the Shanghai-Kunming High-Speed Railway, and the Hangzhou-Ningbo section of the Hangzhou-Shenzhen Railway.

Effective from June 15, 2024, the Hangzhou-Ningbo section will operate at speeds exceeding 300 kilometers per hour. Alongside this operational enhancement, a flexible pricing mechanism will be introduced, allowing fares to vary based on market conditions, seasonality, specific dates, times of day, and class of seating. The adjustments will see an average fare increase of approximately 20% for second class seats across the affected routes.

From a macroeconomic perspective, moderate price increases can serve as a catalyst for economic recovery by enhancing the railway profitability. This principle is applicable in the context of China’s high-speed rail operations, where fare adjustments are strategically implemented to help rail enterprises sustain profitability and thereby support employment. It is well-known that many of China’s high-speed rail lines struggle to achieve profitability, often incurring substantial losses; for instance, China Railway Group reports annual losses amounting to tens of billions of CNY. Given these financial challenges, the implementation of flexible fare adjustments is intended to simulate economic activity and boost the profitability of these crucial infrastructure enterprises.

5.Baidu Vice President Qu Jing Offered an apology on May 9

Recently, Baidu Group Vice President Qu Jing faced substantial public backlash over content she uploaded to her personal TikTok account. This content controversially included remarks such as “approving employees’ applications to leave the company in a second.” As a seasoned public relations expert at Baidu, Qu Jing is adept in managing new media platforms, quickly setting up and promoting her account across various digital channels.

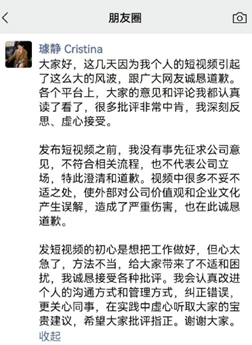

Despite her expertise, Qu Jing stated that her actions on social media are personal and do not typically involve reporting to the company. Following the negative reactions to her video, she acknowledged that she had not consulted with Baidu before posting the video. Consequently, on May 9, she issued a formal apology and expressed a commitment to reflecting on her actions to better align with her professional responsibilities and public expectations.

Given the highly regulated environment in which major corporations like Baidu operate, it is indeed plausible to question whether a video of such potentially sensitive content could be published without at least tacit corporate approval. One potential reason for the video’s release could be Baidu’s “traffic anxiety.” Once a titan in the era of PC-based search engines, Baidu commanded immense traffic and held a leading position in the Chinese internet market. However, the shift to mobile internet saw Baidu losing ground to competitors like Tencent and Alibaba, and more recently to ByteDance and RED (Xiaohongshu).

Nowadays, Baidu’s strategic pivot to platforms like WeChat and TikTok could be seen as an attempt to harness new sources of traffic and reassert its relevance in the competitive landscape. From this perspective, Qu Jing’s controversial video could potentially be interpreted not just as a personal misstep, but as part of a broader, albeit risky, strategy to generate buzz and attract user engagement.

User loyalty and market leadership are built on the quality of the product and service offered, not merely on short-term visibility. Enduring success in the tech industry requires a balanced approach that considers both immediate gains in traffic and long-term reputation management.

0 Comments