1.Over 141 Million Exit-Entry Travelers Recorded in China in Q1 2024

At a press conference held on April 18th, the National Immigration Administration (NIA) disclosed impressive statistics for the first quarter of the year, indicating a significant surge in travel and immigration activities. Over 141 million traveler trips were processed by immigration agencies across the country, marking a 117.8% increase compared to the same period last year. Of these trips, mainland Chinese residents accounted for 69.5 million, while foreign nationals made up 13.1 million trips, showing increases of 114.9% and 305.2% respectively.

Furthermore, the NIA reported that 7.353 million transportation vehicles, including planes, trains, ships, and motor vehicles, were inspected during this period, a rise of 78.3% year-over-year. This total included 194,000 flights, 24,000 trains, 102,000 ships, and 7.033 million motor vehicles, with respective increases of 158.6%, 14.2%, 15.9%, and 78.5%.

In response to this uptick in travel, the NIA has rolled out several immigration and entry-exit policy enhancements. These measures include optimizing regional policies for visa-free entry, transit, and port visas, and implementing five initiatives to ease the process for foreigners visiting China. Notably, visa-free entry options for nationals visiting Hainan Province have been expanded, and efforts to develop a cross-Straits integration demonstration zone in Fujian Province have been supported. The NIA issued “Individual Visit Endorsements” for travel to Hong Kong and Macau to eligible individuals in Xi’an and Qingdao as well.

Other significant statistics include the issuance of 6.357 million regular passports and 24.987 million travel endorsements for trips to and from the Hong Kong SAR, Macao SAR, and Taiwan region, registering year-on-year increases of 24.1%, 30.5%, and 19.9% respectively. The NIA also issued 466,000 visas to foreign nationals, a substantial 118.8% rise from the previous year. Moreover, the entry of foreign nationals into the Chinese mainland soared by 266.1% year-over-year, reaching 1.988 million.

These developments highlight a robust recovery in travel and a proactive approach by the NIA to facilitate international mobility and cross-border exchanges.

Data Source: https://www.nia.gov.cn/n897453/c1645355/content.html

2.China’s Per Capita Savings Total Nearly CNY 110,000

On April 16th, new data from China’s central bank showed that household deposits surged by CNY 8.56 trillion in the first quarter, averaging an increase of approximately CNY 6,114 per person among China’s 1.4 billion population. This marks a continuation of the rising trend in household deposit balances, which have climbed by CNY 10,000 monthly over the last five months. By the end of March, the total balance of household deposits had surpassed CNY 150 trillion, accounting for more than half of the total deposit balance in CNY.

While this increase suggests that residents’ incomes are rising, the interpretation of these figures has sparked debate. On a per capita basis, there seems to be little differentiation between those without savings and billionaires, as this calculation would imply an average holding of CNY 110,000 for each person. This raises questions about the distribution of wealth.

Despite these high averages, the actual savings rate for office workers and rural residents remains significantly below the national average. Indeed, some individuals save less than a quarter of the average amount annually. For most Chinese, reaching these average savings levels is a significant challenge.

A revealing study from China Merchants Bank highlights a stark disparity: just 2% of its super VIP clients hold 82% of the total wealth managed. This finding not only defies the traditional 80/20 rule but also underscores the increasing wealth gap between the affluent and the less fortunate.

3.The Huawei Pura 70 is Currently On Sale

At 10:08 a.m. Beijing time on April 18, Huawei made waves in the tech world by announcing the launch of its Pura 70 series, breaking away from the traditional naming of its P series. Despite the omission of specific core processor details on the product’s parameter page, market sources confirm that the Pura 70 series is a 5G-enabled device powered by the Kirin chip. Remarkably, the new models sold out on Huawei’s official website in under a minute after their release.

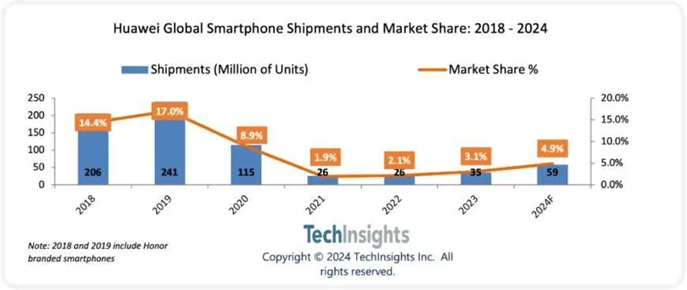

In the wake of the Pura 70 series launch, TechInsights released a report shedding light on Huawei’s recent performance and future prospects: with earlier market entry and reduced supply constraints, the Pura 70 series is expected to ship over 10 million units in 2024, positioning it as a formidable rival to Apple’s upcoming iPhone 15 and 16 series. The Pura series, which has a more youthful and radical design, immediately triggered a strong market response and significant media attention globally.

CNBC highlighted that Huawei has packed these devices with premium features at competitive prices, directly challenging Apple’s iPhone 15 series. This strategic pricing is poised to influence Chinese consumers’ choices, especially with Apple’s planned upgrades in September.

Further anticipation builds as Huawei is also set to release the Mate 70, expected to resonate well with Chinese consumers accustomed to Huawei’s high-quality offerings. TechInsights forecasts that Huawei’s smartphone shipments in China will surpass 50 million units in 2024, increasing its market share from 12% in 2023 to 19% in 2024. This surge is anticipated to boost Huawei back to the leading position in the Chinese smartphone market.

4.Wang Jianlin, the Founder of Wanda, Formally Farewelled the Wanda Cinema Business

On April 17th, Beijing Wanda Culture Industry Group Limited announced significant changes to its ownership structure. Wang Jianlin, the company’s founder, transferred 20% of his equity in Beijing Wanda Investment Co., along with an additional 1.2% individual equity in Wanda Culture, to Shanghai Ruyi Investment Management Co. This transaction, which has already completed its industrial and commercial registration procedures, effectively transfers control of the company.

With this latest transfer, Ruyi Group now owns 100% of Beijing Wanda Investment Co.’s shares. As Beijing Wanda Investment is the controlling shareholder of Wanda Cinema, Ruyi Group’s acquisition also results in its indirect control over Wanda Cinema. Ke Liming, the head of Ruyi Group, has thus replaced Wang Jianlin as the principal controller of Wanda Cinema.

This transaction marks another chapter in a series of equity shifts involving Wanda Cinema, reflecting broader strategic realignments by Wanda. Industry experts suggest that Wanda’s rapid moves to liquidate assets are driven by an urgent need to boost cash flow.

For Wang Jianlin, once considered China’s wealthiest individual, the resolution of a series of significant legal and financial issues will be a significant step towards a more stable future. Nevertheless, the path ahead remains fraught with uncertainties, with 2024 likely to be a pivotal year for Wang’s ongoing financial challenges.

5.China Witnesses Sharp Decline in Kindergartens: 40 Closures Daily and 170,000 Teacher Reduction Annually

According to recent statistics from China’s Ministry of Education, the country has seen a notable decline in the number of kindergartens, with an average of 40 institutions closing each day over the past year. This trend has reduced the total number of kindergartens from 274,400 in 2022 to 259,600 in 2023, a decrease of 14,800 facilities. The National Education Development Statistics Bulletin also highlighted a significant reduction in the workforce, with the number of full-time preschool teachers dropping by 170,000 from 3,244,200 in 2022 to 3,073,700 in 2023. This downsizing has prompted many educators to reconsider their professional trajectories. While some continue to work with young children in roles such as childcare or maternity center staff, others have transitioned to entirely different fields, including internet operations.

The closure of kindergartens is not isolated to the preschool level but is expected to have cascading effects on elementary, secondary, and higher education levels as well. However, some industry observers see these closures as potentially beneficial, advocating for a focus on enhancing the quality of remaining institutions. They argue that the competitive market is forcing subpar private kindergartens to shut down, paving the way for a more standardized and professional preschool education sector.

This shift also simplifies the decision-making process for parents, who previously faced challenges in choosing a suitable kindergarten. Previously, selecting a kindergarten was often challenging for parents, but with the reduction in options, parents are now able to identify their optimal kindergarten more readily easily.

This trend underscores the evolving landscape of early childhood education in China, emphasizing quality over quantity in the face of significant market pressures.

0 Comments