1.China’s CPI Increased by 0.1% y-o-y and Decreased 1.0% Compared to February

In March 2024, national consumer prices rose 0.1% year-on-year. Among which, urban areas were flat while rural areas rose by 0.1%; food prices fell by 2.7% and non-food prices rose by 0.7%; prices of consumer goods fell by 0.4% and prices of services rose by 0.8%. From January to March, the nation’s consumer prices remained unchanged on average from the same period of the previous year.

On a month-to-month basis, national consumer prices fell 1.0% from a year earlier. Among them, urban fell by 1.0% and rural fell by 0.7%; food prices fell by 3.2% while non-food prices fell by 0.5%; consumer prices and service prices fell by 0.9% and 1.1% respectively.

In March, food, tobacco and alcohol prices fell by 2.2%, affecting the CPI by about 0.61 percentage points. Among food products, the price of fresh vegetables decreased by 11.0%, affecting the CPI by about 0.27 percentage points; the price of fresh fruits decreased by 4.2%, affecting the CPI by about 0.09 percentage points; the price of livestock and meat decreased by 3.9%, affecting the CPI by about 0.12 percentage points, of which the price of pork decreased by 6.7%, affecting the CPI by about 0.09 percentage points; the price of eggs decreased by 3.8% , affecting CPI down about 0.02 percentage points; aquatic products prices fell 3.5%, affecting CPI down about 0.07 percentage points.

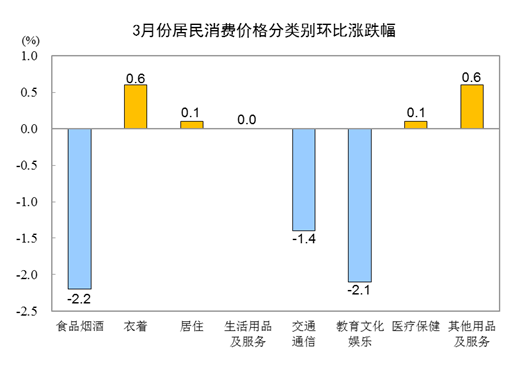

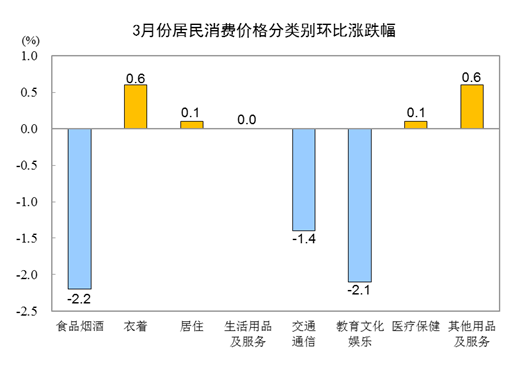

The other seven major categories of prices witnessed both rise and fall. The prices of clothing, other goods and services rose 0.6% while residential and health care prices rose 0.1%; living goods and services prices were flat; education, culture and entertainment, transportation and communication prices fell 2.1% and 1.4% respectively.

Data Source: https://www.stats.gov.cn/sj/zxfb/202404/t20240411_1954446.html

2.Layoff Hit Two Tech-giants, Amazon and ByteDance, As Firms Aim to Boost Efficiency

On April 8th, several employees at Amazon China received emails notifying them of the layoff, marking a significant move in Amazon’s ongoing strategy to streamline operations. The emails explained that after assessing various business areas, Amazon identified redundancies in roles including project management and sales operations. This led to the decision to cut hundreds of positions within specific sales, marketing, and global services organizations. These layoffs are part of a broader strategic realignment by Amazon to shift resources and focus on more profitable sectors, despite the provision of generous severance packages. This decision has sparked concerns and dissatisfaction among employees, not just in China, but in Canada and other regions as well.

Globally, Amazon has laid off almost 30,000 employees over the past two years. Despite this, the company, under CEO Andy Jassy’s leadership, continues to tighten operations by cutting costs and discontinuing several initiatives started under Jeff Bezos, especially those accelerated during the pandemic’s peak.

Simultaneously, ByteDance’s office system, Feishu, is also making significant personnel changes, affecting 20% of its workforce. On March 26th, Feishu CEO Xie Xin communicated to employees the need to enhance team efficiency and the product’s competitive edge, particularly in AI capabilities. Xie noted that despite the size of the Feishu team, inefficiencies and a lack of focus were hampering long-term business growth, necessitating a reduction in staff.

Both Amazon and ByteDance are adapting to the fast-evolving tech industry, recognizing that agility and efficiency are crucial for staying competitive. These changes underscore a strategic emphasis on refining operations, aligning with corporate priorities, and eliminating redundancies to better prepare for future challenges.

3.Blizzard Games will be Available in Mainland China this Summer through NetEase

On April 10th, Blizzard Entertainment, Microsoft Games, and NetEase announced a landmark agreement to reintroduce beloved Blizzard titles to mainland China this summer, under a revised game distribution agreement. This deal reaffirms commitments to all previously covered games, including iconic series such as World of Warcraft®, The Legend of Hearthstone®, and franchises from the Warcraft®, Overwatch®, Diablo®, and StarCraft® universes.

The relationship between Blizzard and NetEase, which began in 2008 with NetEase managing StarCraft II, Warcraft III, and the Battle.net platform, ended in January 2023 after 14 years. The ensuing year was marked by complex negotiations and widespread speculation, with fans eagerly awaiting Blizzard’s return, nostalgically declaring, “My youth is back.”

Johanna Faries, President of Blizzard Entertainment, expressed excitement about reviving the partnership with NetEase to enhance gaming experiences in China. Ding Lei, CEO and Director of NetEase, emphasized their continued dedication to delivering innovative and exciting entertainment, maintaining a trusted and respectful relationship with users. Both leaders are committed to amplifying the joy within the gaming community. Phil Spencer, CEO of Microsoft Games, which acquire Blizzard by $68.7 billion, noted the deep connection between Blizzard’s universes and Chinese gamers, expressing enthusiasm for reintroducing these legendary games to China. He also discussed plans to expand the Xbox game portfolio, underscoring a global commitment to gamers.

During Blizzard’s absence, the Chinese market saw an influx of alternative and overseas games. Official figures from the National Press and Publication Administration show that since the beginning of 2024, over 333 domestic and 46 imported games have been approved. This surge has significantly increased competition, presenting Blizzard with the challenge of reestablishing its market presence amid a transformed gaming landscape. This scenario underscores the intense competition Blizzard faces as it strives to regain its foothold and share in this dynamic market.

4.JD.com Confirmed that It Invested RMB 1 billion in Short Video Track

On April 10, a representative from JD.com announced that the company will invest 1 billion in cash and an additional 1 billion in traffic incentives to attract more original content creators and high-quality content organizations. The investment aims to support creators across over 20 creative domains, including digital electronics, home and kitchen appliances, maternity and baby products, pet care, fashion, sports, beauty, health, and automotive products. Furthermore, JD.com plans to increase visibility for high-quality, original video content, enhancing exposure opportunities.

As the content ecosystems of various platforms evolve, key opinion leaders (KOLs) and live streaming organizations are increasingly evaluating platform metrics. These metrics include audience demographics, platform tone, the quality of merchant advertisements, user engagement, and the rate of fan growth. These factors are crucial for these organizations to strategize their resource allocation effectively.

It is noteworthy that while e-commerce giants like JD.com are expanding into short video content, platforms such as TikTok are simultaneously venturing into the e-commerce space. Industry experts observe that regardless of the content format—whether it is short videos on e-commerce platforms or e-commerce ventures on video platforms—the overarching objective remains centered on e-commerce. This trend underscores the blurring lines between social media and online retail, highlighting a strategic pivot towards integrated digital commerce solutions.

5.Lu Zhengyao, the Founder of Luckin and Cotti, Enforced to Pay CNY 1.89 Billion

On April 7th, the Enforcement Information Public Network (EIPN) revealed that””” Lu Zhengyao had disclosed new details about a case involving more than CNY 1.89 billion. The proceedings, overseen by Beijing’s No. 4 Intermediate People’s Court, highlighted Lu’s nine consumption restrictions and an outstanding case total exceeding CNY 2.5 billion. Additionally, two equity freezing incidents concerning UCAR INC were reported.

Opinions on Lu Zhengyao vary widely. Some label him a “giant fraud,” accusing him of manipulating market dynamics, while others praise him as a commercial visionary with business acumen and the ability to seize emerging opportunities.

Amid these controversies, questions arise about the impact on Cotti Coffee, a brand associated with Lu. Despite the legal challenges, Cotti Coffee asserts that its operations and cash flow remain unaffected. However, the reality might be more complex.

Since its inception, Cotti Coffee has emphasized rapid growth. In just 14 months starting October 2022, it launched around 7,000 stores, marking a record expansion that became synonymous with the brand. The company’s revenue primarily derives from franchise fees and supply chain operations. However, the pace of new store openings has dramatically slowed, with the brand now depending on a shrinking pool of new franchise fees to sustain its extensive network.

On February 26, 2024, in the face of tightening cash flow, Cotti Coffee launched a “9.9 Unlimited Good Coffee” promotion. Despite this effort, high costs for raw materials, rent, and labor are squeezing profitability, underscoring a fragile financial position.

Lu Zhengyao’s ongoing legal issues could significantly affect Cotti Coffee’s ability to secure external financing and maintain smooth operations, potentially damaging the brand’s market reputation and eroding consumer trust.

0 Comments