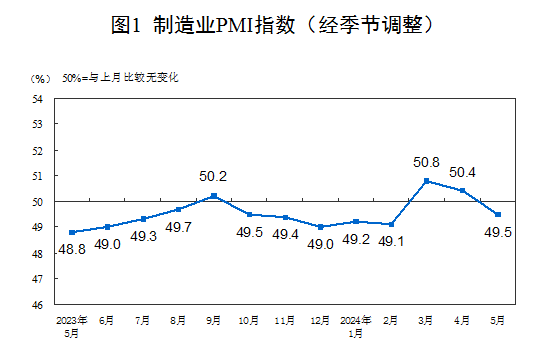

1.China’s Manufacturing PMI for May was 49.5, While the Non-manufacturing Sector Continued to Expand

According to the data released by National Bureau of Statistics on May31, in May, the Manufacturing Purchasing Managers’ Index (PMI) was 49.5%, a decrease of 0.9 percentage points from the previous month.

When viewed by company size, the PMI for large enterprises was 50.7%, an increase of 0.4 percentage points from the previous month; the PMI for small and medium-sized enterprises stood at 49.4% and 46.7%, respectively, dropping by 1.3 and 3.6 percentage points from the previous month.

Looking at the sub-indices that comprise the manufacturing PMI, production index (50.8%) and supplier delivery time index (50.1%) still remained above the critical threshold, while decreasing by 2.1 percentage points and 0.3 percentage points. Meanwhile, employment index (48.1%), increasing by 0.1 percentage points, raw material inventory index (47.8%) and new orders index (49.6%) , dropping by 0.3 percentage points and 1.5 percentage points, were below the critical threshold.

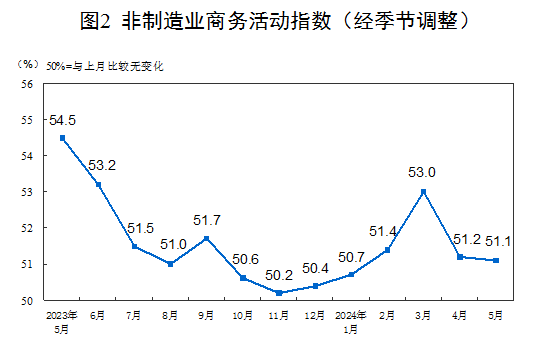

In May, the non-manufacturing business activity index was 51.1%, remaining largely unchanged from the previous month, indicating continued expansion in the non-manufacturing sector.

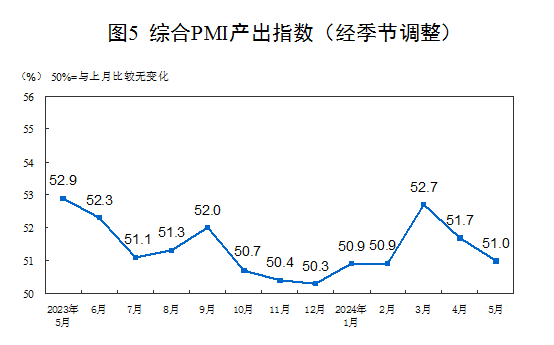

In May, the Composite PMI output index was 51.0%, a decrease of 0.4 percentage point from the previous month, but still above critical threshold, indicating that business production and operations in China continue to recover and develop.

Data Source: https://www.stats.gov.cn/sj/zxfb/202405/t20240530_1956234.html

2.China Suspends Tariff Concessions on 134 Taiwanese Products Under Cross-Strait Economic Cooperation Framework Agreement

On May 31, Chen Binhua, spokesperson for the Taiwan Affairs Office of the State Council, announced that according to the Cross-Strait Economic Cooperation Framework Agreement (ECFA), the Tariff Policy Commission of the State Council has decided to suspend tariff concessions on certain products from Taiwan. Effective June 15, 134 categories of imported goods, including base oils for lubricants listed in the annex, will no longer benefit from the ECFA tariff rates and will be subject to the prevailing regulations.

The suspension follows discriminatory bans and restrictions imposed unilaterally by Taiwan on mainland Chinese products, violating the provisions of the ECFA. Despite the announcement of Tax Committee Notice No. 9 in 2023 by the Tariff Policy Commission on December 21, 2023, which suspended tariff concessions on certain products, Taiwan has not taken any effective measures to lift its trade restrictions against the mainland.

Data Source: http://www.gwytb.gov.cn/m/fyrbt/202405/t20240531_12624452.htm

3.BYD Chairman Wang Chuanfu’s Prediction Came True That The End of Fuel Cars will come

On May 28, BYD held a conference beneath the historic city wall in Xi’an. During the event, Chairman Wang Chuanfu declared that new energy vehicles have become mainstream, while traditional fuel vehicles are now the non-mainstream option. He also emphasized that Chinese brands are leading the world in automotive technology innovation.

As of mid-April this year, the penetration rate of new energy passenger cars in China has exceeded 50%. Concurrently, the decline of joint-venture brands, particularly Japanese models, is accelerating. In the first quarter of this year, sales of GAC Toyota and GAC Honda fell by 24.11% year-over-year, making them the only top performers to experience a decline of over 20%. China is the global leader in new energy vehicle production and sales, holding 62% of the world’s market share. China’s top six power battery suppliers account for 63% of global battery loading, while Chinese new energy vehicle patent disclosures constitute 70% of the global total. Wang Chuanfu predicted that the market share of joint-venture brands in China will soon fall to less than 10%.

At the conference, BYD also unveiled the Qin L and Seal 06, featuring the latest fifth-generation DM technology. These vehicles boast 46% engine thermal efficiency, 2.9L fuel consumption, a range of 2,100 kilometers, a minimum price of CNY 99,800, additionally a CNY 15,000 replacement subsidy available and 24 periods of 0% interest. The announcement of the new vehicle prices generated significant excitement among attendees.

4.PwC Has Experienced A Series of Significant Losses in China

On May 27, China Merchants Bank announced the appointment of new accounting firms, selecting Ernst & Young to replace PwC for auditing services. According to WIND data, PwC audited 107 A-share listed companies in FY2023, with total audit fees amounting to CNY 869 million. However, in recent weeks, several major Chinese companies, including China Railway, China Life, PICC, Myriad Healthcare, Shanghai Silicon Industry, Qingdao Port, and Guangdong Electric Power A, have announced plans to switch from PwC to other audit firms. Industry insiders speculate that this wave of changes is linked to the controversy surrounding PwC’s involvement in the Evergrande forgery case.

Previously, PwC was embroiled in the Evergrande counterfeiting scandal. Public records indicate that PwC served as China Evergrande’s auditor since the company’s listing in 2009. This cooperation ended in January 2023, after 14 years. During this period, PwC issued unqualified audit reports, failing to meet professional obligations, which allowed a major real estate company’s debt crisis to remain concealed for an extended period, misleading massive investors.

As the Evergrande situation continues to unfold, there is growing concern that PwC’s China operations may face similar challenges.

5.A Chinese Province Embraces Flying Taxis and Drones to Propel Economic Diversification

Shanxi, one of China’s less economically developed provinces, traditionally known for its industrial-led economy, is making strides to diversify by investing in emerging technologies. As part of a national initiative to boost innovation and invigorate its economy, Shanxi is purchasing “flying taxis” and subsidizing drone development.

On last Friday, May 31, eVTOL manufacturer EHang announced that Taiyuan Xishan Ecological Tourism Investment Construction, owned by the municipal government of Taiyuan, Shanxi’s capital, placed a CNY 113 million order for 50 fully autonomous, two-passenger EH216-S drones. This agreement follows the release of guidelines by China’s top economic planner, the National Development and Reform Commission (NDRC), aimed at promoting consumer spending in tourism to stimulate consumption.

In addition to these efforts, Shanxi is allocating substantial funds to develop the low-altitude economy. The province is subsidizing up to half the cost of establishing support services for low-altitude flights and airport expansions, with each airport eligible for up to CNY 30 million in subsidies and training bases up to CNY 10 million, as announced by the Shanxi provincial government last week.

Other provinces, such as Zhejiang on the east coast, are also leveraging local government bonds and ultra-long treasury bonds to build new infrastructure for civil aviation and low-altitude flights. While the central government has shown strong support for developing the drone and flying taxi industries, analysts remain cautious about the safety, reliability, and cost-effectiveness of these technologies.

0 Comments